Bitcoin is once again knocking on the door of price discovery, but researchers at Bitwise Asset Management argue that spot quotations still understate what the network is worth. In their Week 24 Crypto Market Compass circulated late Tuesday, Dr. André Dragosch, Bitwise’s Head of Research for Europe, and analyst Ayush Tripathi calculate that “quantitative models estimate Bitcoin’s hypothetical ‘fair value’ amid the current sovereign default probabilities at around $230,000 today.” The figure implies a premium of just over 110 percent to the market price, which was hovering near $109,600 at press time on 11 June 2025.

Bitcoin’s ‘True Worth’ Is Explosive

Dragosch ties that assessment to the rally in sovereign-risk hedges. United-States one-year credit-default-swap spreads are trading near half-percentage-point territory—levels last seen during the 2023 debt-ceiling scare—reflecting “broader concerns over the US fiscal deficit,” Reuters reported last week. “Bitcoin can provide an alternative ‘portfolio insurance’ against widespread sovereign defaults as a scarce, decentralised asset which is free of counterparty risks,” the note argues, adding that net interest outlays projected by the Congressional Budget Office point to a tripling of US debt-service costs to roughly $3 trillion by 2030.

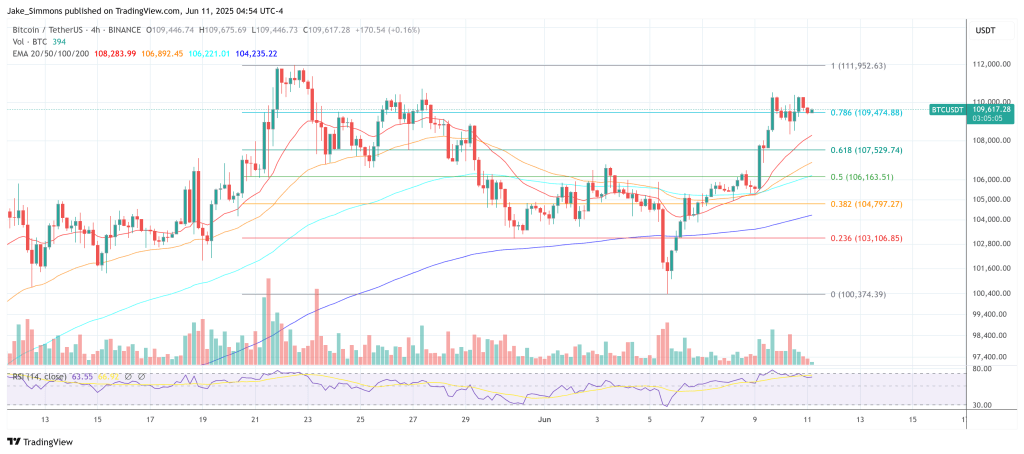

The macro backdrop, however, is not the only pillar supporting Bitwise’s fair-value call. The firm’s in-house Cryptoasset Sentiment Index shows twelve of fifteen market-breadth gauges trending higher, while the cross-asset risk-appetite index (CARA) compiled from equities, credit, rates and commodities has surged to a five-year high. “Both cryptoasset and cross-asset sentiment are now decisively bullish,” Dragosch writes, noting that Bitcoin’s climb back above $110,000 places it within two percent of the all-time high near $112,000 set in May.

On-chain data remain constructive. Exchange reserves have slipped to 2.91 million BTC—about 14.6 percent of the circulating supply—after whales withdrew an estimated 390,632 BTC last week. At the same time, net exchange-spot outflows slowed to roughly $0.53 billion from $1.78 billion the previous week, suggesting lighter profit-taking pressure.

Derivative positioning echoes the spot-market resilience. Aggregate Bitcoin futures open interest added 2,200 BTC across venues, while the CME leg gained 6.4 k BTC. Funding rates on perpetual swaps stayed positive overall despite flipping negative for parts of the weekend, and the three-month annualised basis held around 6.3 percent. In options, open interest expanded by 27,300 BTC, with the put-to-call ratio settling at 0.55; one-month 25-delta skew remained modestly negative, implying continued demand for downside hedges even as realised volatility slipped to 28.2 percent.

Institutional flows are reinforcing the bullish tone. Global crypto ETPs absorbed $488.5 million last week, of which $254.9 million went into Bitcoin products. US spot Bitcoin ETFs led the charge with $525 million of inflows, counterbalanced by a $24.1 million weekly leak from the Grayscale Bitcoin Trust. Bitwise’s own BITB vehicle attracted $78.1 million, while its European physical Bitcoin ETP (BTCE) saw only marginal outflows. Ethereum products also enjoyed $260.9 million in net inflows, maintaining the broad-based risk bid.

Bitwise concedes that headline risk can still provoke sharp, short-lived drawdowns—last week’s spat between Elon Musk and President Donald Trump briefly drove BTC back to $100,000—but sees structural forces firmly tilted to the upside. “US economic policy uncertainty has most likely passed its zenith already and continues to decline at the margin,” Dragosch writes, pointing to May non-farm-payroll growth of 139,000 and a moderation in recession odds.

With Bitcoin already outperforming traditional assets year-to-date and cross-asset sentiment now confirmed by Bitwise’s indicators, the analysts argue that the market is beginning to price the asset less as a speculative vehicle and more as a macro hedge. Whether traders embrace the $230,000 fair-value marker hinges on the same variables underscored in the note—sovereign-risk premiums, policy uncertainty and the pace of institutional adoption—but the groundwork, they say, is visible on-chain, on desks and in the flow data.

“Bitcoin also reclaimed 110k USD and is close to its previous all-time high,” the report reminds readers. For Bitwise, that proximity is not an end point but a staging area: the monetary asset’s intrinsic value, they conclude, resides “considerably further north.”

At press time, BTC traded at $109,617.