Bitcoin’s attempt to overtake the $120,000 milestone was stopped once again in its tracks, and the asset fell by nearly four grand in hours before it staged a recovery.

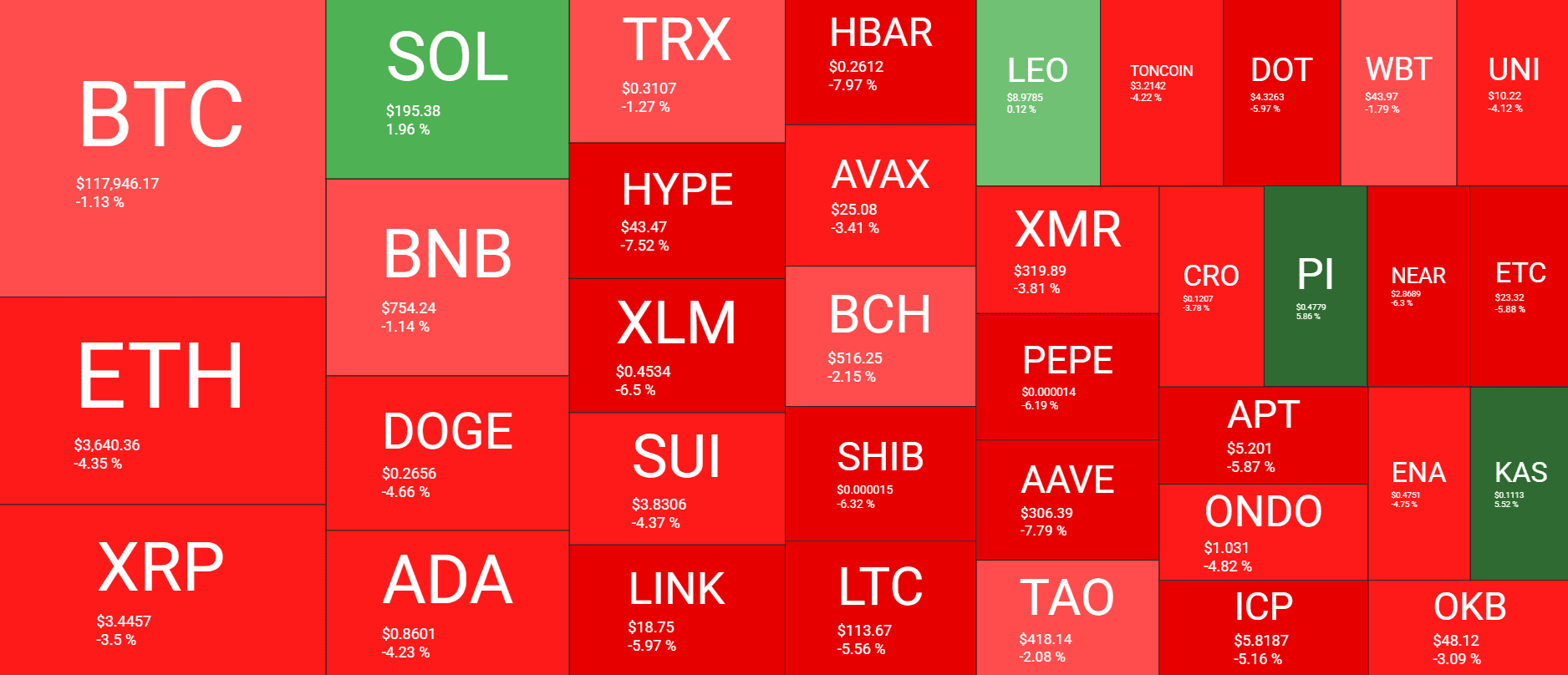

The altcoins are well in the red after marking substantial gains yesterday, with HYPE, XLM, and HBAR posting the most substantial losses.

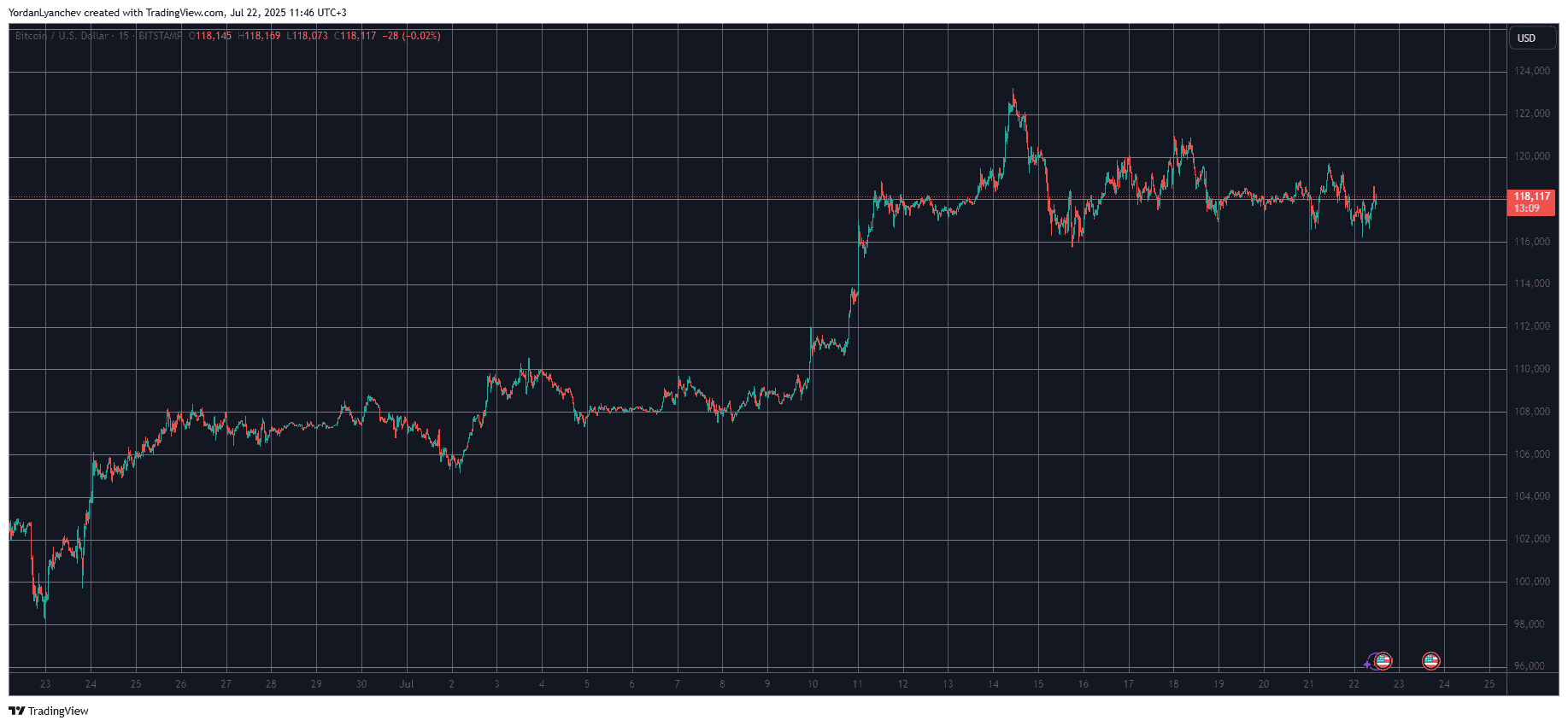

BTC Rejected at $120K

Ever since last Monday, when BTC reached its latest all-time high above $123,000, it has been unable to recapture its momentum, which has swung toward the altcoins. In the following week, the cryptocurrency went into another consolidation phase, losing some ground and trading sideways around $118,000.

It tried to take down the $120,000 resistance on a couple of occasions last week but to no avail. The subsequent retracements were met with buying pressure, and bitcoin returned to its consolidation price once again.

The same scenario repeated at the start of the current business week. BTC jumped toward $120,000 but was stopped in its tracks and pushed south to just over $116,000. It has recovered some ground and now sits around $118,000.

Its market capitalization has calmed at around $2.350 trillion, while its dominance over the alts stands at just over 59% on CG.

PI Defies the Trend

Most larger-cap altcoins have cooled off following the gains registered on Monday. ETH reached a new multi-month peak of roughly $3,800, but it’s well below $3,700 after a 4.5% daily decline. XRP came close to charting a new all-time high but was stopped and sits at $3.45 now. ADA, DOGE, TRX, SUI, and AVAX have all marked similar losses.

The biggest daily declines, though, come from the likes of HYPE, XLM, HBAR, LTC, LINK, and AAVE. SOL is among the few exceptions as it touched $200 earlier today.

Pi Network’s native token is another one, as it has jumped by over 6% to $0.477. KAS is also in the green.

The total crypto market cap has erased around $60 billion since yesterday and is well below $4 trillion now.

The post Pi Network’s PI Token Defies Altcoin Correction, Bitcoin Stopped at $120K: Market Watch appeared first on CryptoPotato.