Bitcoin’s somewhat expected correction drove the asset to under $116,000 yesterday, but it has managed to bounce off and now sits close to $119,000.

Many altcoins have posted impressive gains over the past day, led by Ethereum’s 6% surge to a five-month high.

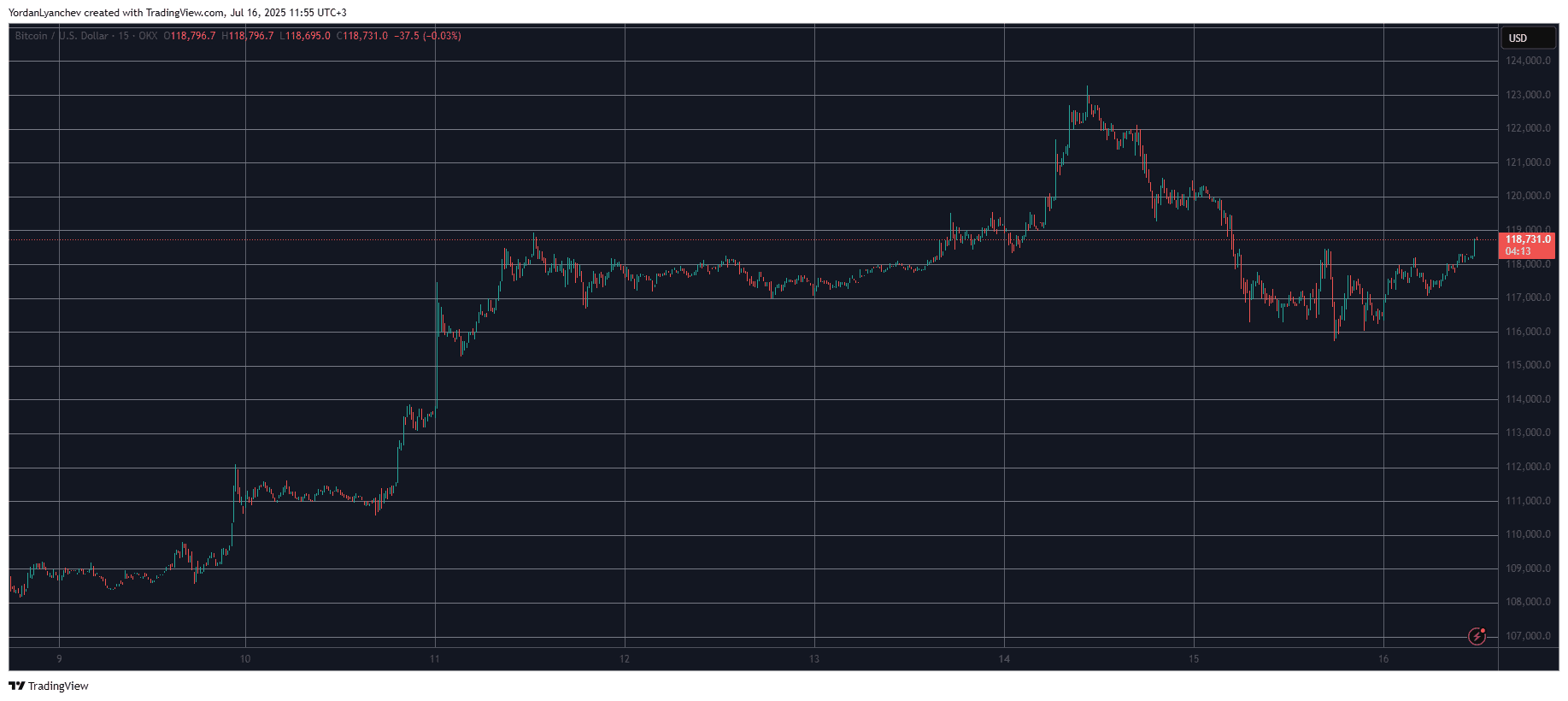

BTC Eyes $119K

The primary cryptocurrency’s historic ascent began last Wednesday. At the time, it was confined in a tight range with an upper boundary of $110,000, which managed to contain the asset during a few breakout attempts.

However, the bulls took charge on Wednesday evening and pushed through it to a new all-time high of $112,000. The gains continued in the following 48 hours, and BTC topped at almost $119,000. Following a relatively quiet weekend, bitcoin jumped further on Monday and registered its latest ATH of just over $123,000.

After skyrocketing by $15,000 in five days, the asset was due for a cool-off, which took place yesterday. Amid billions of realized profits, shaky US CPI data, and some uncertainty in the global political scene, bitcoin slipped by several grand and dipped below $116,000.

It has reacted well following this decline and has recovered almost $3,000. It now sits close to $119,000, with a market capitalization of $2.360 trillion. Its dominance over the alts, though, has taken a hit and is down to 61.7% as many altcoins have produced bigger gains.

ETH Leads the Alts’ Rally

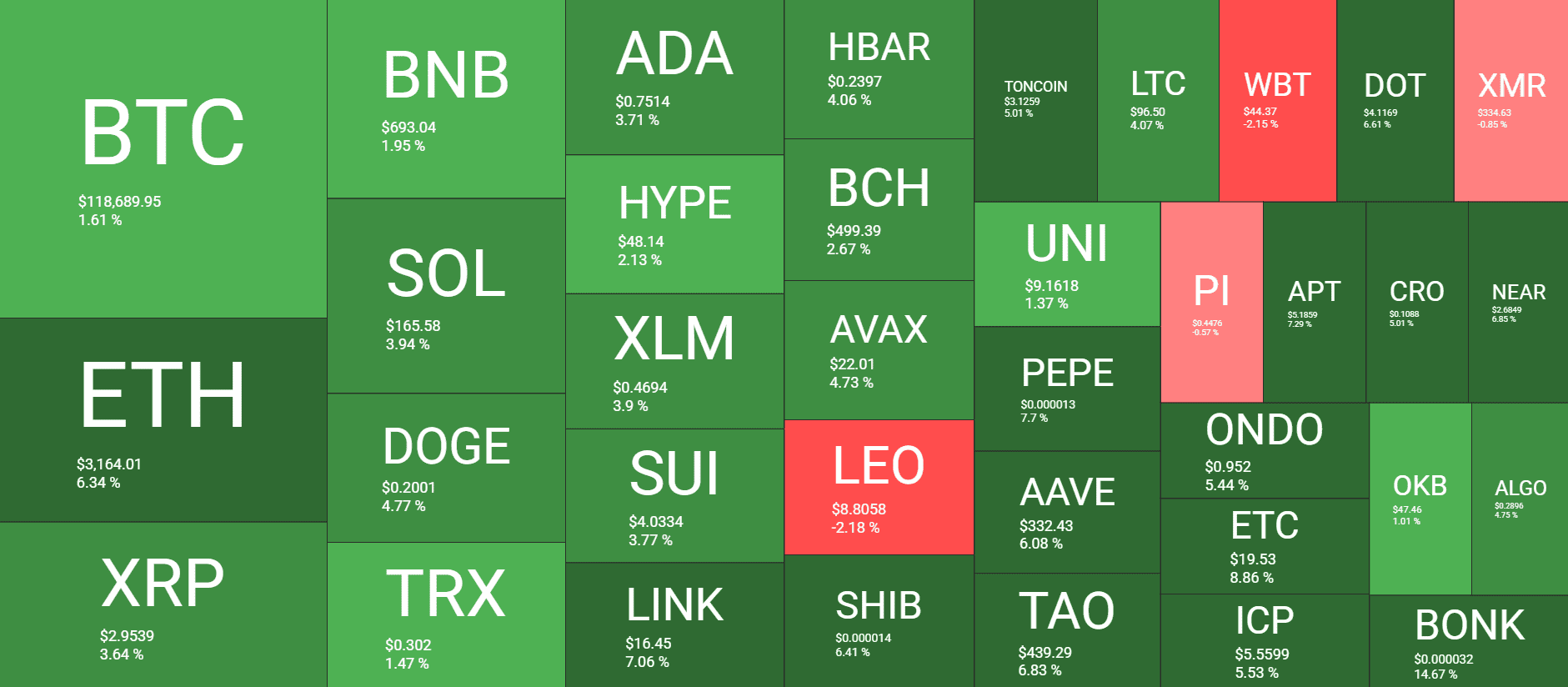

As mentioned above, many altcoins have outperformed BTC on a daily scale. Ethereum is among the leaders, as it has pumped by more than 6% and now sits at over $3,150 for the first time in over five months. LINK, SHIB, TON, PEPE, AAVE, and TAO have marked similar gains.

XRP has neared the crucial resistance at $3 after a 3.5% daily jump, while BNB has closed the gap to $700. SOL, DOGE, ADA, XLM, and SUI are also in the green, albeit in a more modest manner.

The total crypto market cap has recovered roughly $100 billion since yesterday’s low and is up to $3.830 trillion on CG.

The post Bitcoin Price Eyes $119K, Ethereum Surges to 5-Month Peak: Market Watch appeared first on CryptoPotato.