It was another eventful week in the overall scheme of things, but bitcoin and crypto remained relatively resilient and even stable in terms of prices.

It all started last Friday morning when Israel launched a missile attack against Iran, killing over 70 people in the process, including several high-end commanders and nuclear scientists. Given the surprise nature of the attack, it was no wonder that BTC’s price tumbled in response, going from over $108,000 to under $103,000 in minutes.

The situation continued to escalate in the following days, with Iran retaliating and Israel doubling down on its attacks. The US President Donald Trump was vocal on the matter, urging Iran to make a nuclear deal before it’s too late.

Despite the increasing tension, BTC’s price actually recovered some ground and spent the next few days around $104,000-$105,000. It skyrocketed once the business week started and jumped to $109,000 on Tuesday. However, that was a short-lived rally, and its price dropped immediately to $103,500.

The focus turned to the US Fed, which concluded its latest FOMC meeting on Wednesday. To the surprise of no one, it left the interest rates unchanged, and bitcoin’s price remained flat at around $104,000.

On Friday, though, BTC started to gain some traction and spiked above $106,000 for just the second time this week. It currently hovers around that level amid reports that Iran is considering inserting certain limitations on its Uranium program. Such a price tag means that bitcoin is actually slightly up on a weekly scale.

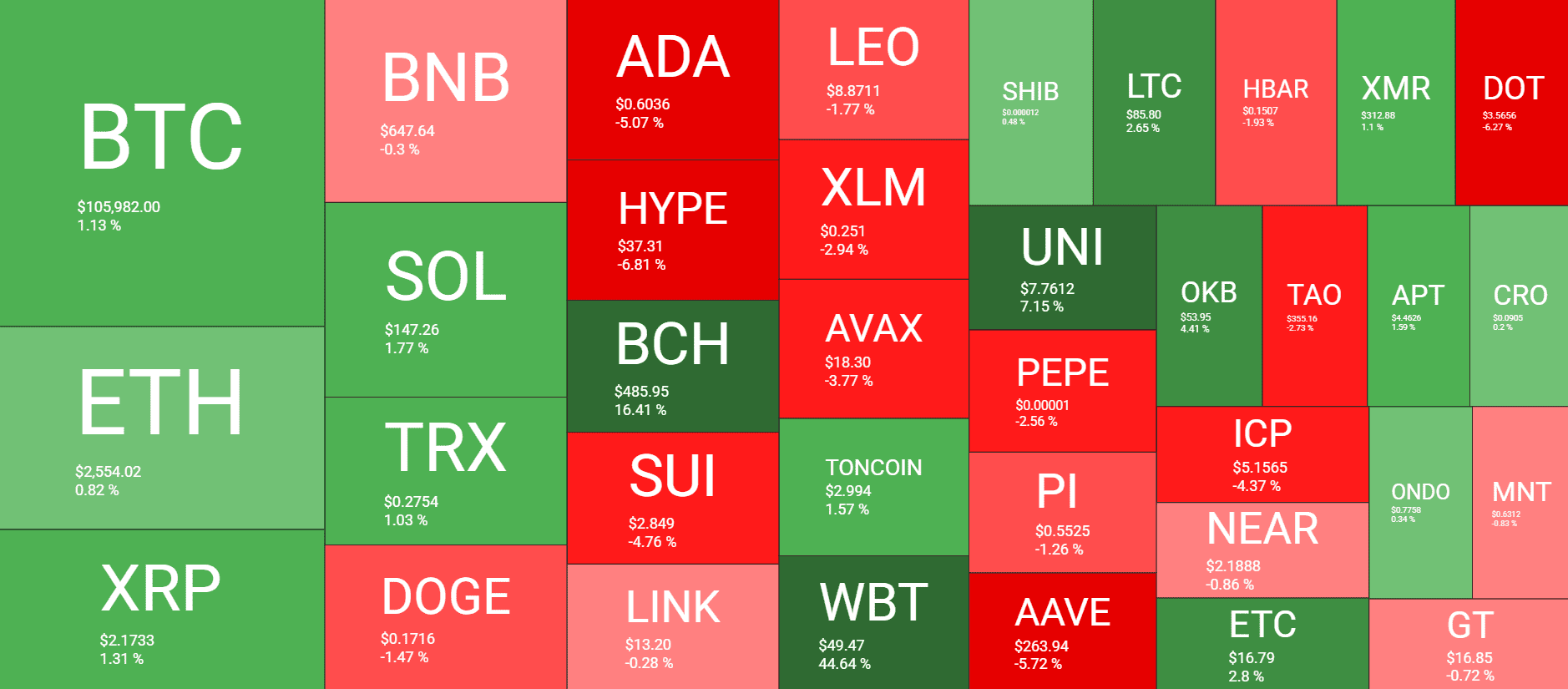

The top performer in this regard from the larger-cap alts is WBT, which set a new all-time high earlier this week. Despite retracing slightly since then, it’s still 45% up weekly. Bitcoin Cash trails behind with a 17% surge, while UNI is third with a 6.6% jump.

In contrast, HYPE has slipped by over 7% in the same timeframe, followed by ADA (-5%), SUI (-5%), and DOT (-6%).

Market Data

Market Cap: $3.406T | 24H Vol: $103B | BTC Dominance: 61.8%

BTC: $106,100 (+1.2%) | ETH: $2,560 (+0.8%) | XRP: $2.17 (+1.5%)

This Week’s Crypto Headlines You Can’t Miss

Justin Sun’s Tron to Go Public in the US: Report. The warm relationship between Tron’s Justin Sun and the current US presidential administration seems to be paying off. According to a recent report, the blockchain project is planning to go public in the US through a reverse merger with SRM Entertainment.

GENIUS Act Clears Senate, Setting the Stage for Stablecoin Oversight. The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act passed the US Senate with an overwhelming 68 to 30 vote on June 17. The bill now needs to be approved by the House, which is controlled by the Republicans.

Ethereum Breaks Records: 35M ETH Staked, 22.8M Held Long-Term. Although ether’s price has stagnated recently, the token is continuously being staked and transferred to long-term holders, who are less inclined to sell.

Not Enough Bitcoin: What Does The Skyrocketing Ancient BTC Supply Tell Us? The available supply of bitcoin seems to be drying up. According to a recent report by Fidelity, an average of 566 BTC per day is falling into a long-term “ancient supply” bucket, while the daily issuance rate of BTC is just 450.

Bitcoin at $100K Shows Institutional Dominance, Not Retail FOMO. On-chain data reveals that retail investors are still missing, as the smaller transactions are lacking. This means that bitcoin’s price is being supported above $100,000 mostly by institutional players, as the network activity shows primarily large transactions.

They Keep Buying: Strategy, Metaplanet, Genius. It wasn’t really a surprise on Monday when Michael Saylor announced the latest BTC acquisition by Strategy, which is back in the billions of dollars. Before the NASDAQ-listed company, Metaplanet also outlined its latest bitcoin purchase, while Genius Group expanded its BTC holdings by 52% despite some regulatory issues.

Charts

This week, we have a chart analysis of Binance Coin, Ripple, Cardano, Hype, and Solana – click here for the complete price analysis.

The post BTC Price Stabilizes After FOMC Meeting as Israel-Iran Conflict Awaits Trump’s Next Move: Your Weekly Crypto Recap appeared first on CryptoPotato.