World Liberty Financial (WLFI), a crypto project backed by US President Donald Trump, moved a chunk of its Bitcoin exposure into Ethereum this week. Reports say the group sold wrapped Bitcoin holdings and picked up a large amount of Ether in the same set of transactions.

WLFI Moves From WBTC To ETH

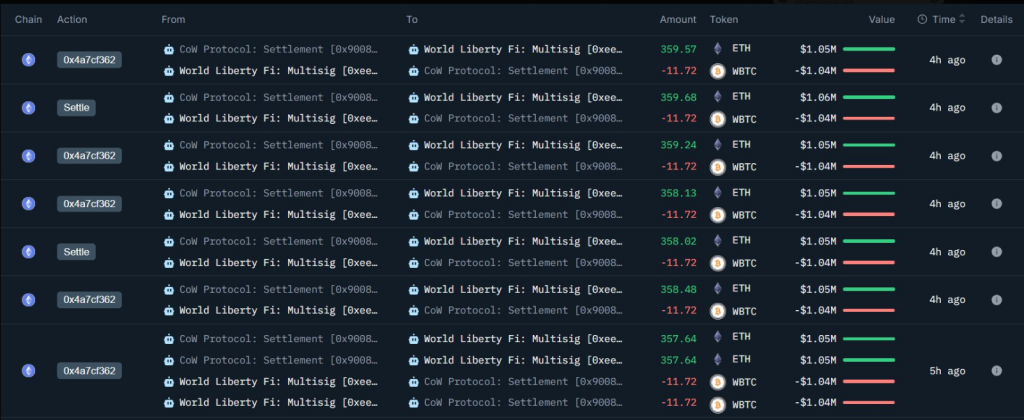

According to blockchain trackers, about 93.77 WBTC was sold, which worked out to roughly $8 million at the time of the swap. The proceeds were used to buy around 2,868 ETH, with an average price of about $2,813 per unit.

The trade was executed from a wallet that on-chain analysts link to WLFI’s treasury. That wallet activity was visible on public ledgers and has been shared across several crypto news sites and data monitors.

Onchain Data And Market Context

Prices were modestly lower for ETH when the purchase happened, which some traders see as a buying chance. Reports say this move comes as Ethereum trading ranges have made some holders rethink where to park large sums.

The World Liberty Finance (@worldlibertyfi) has sold 93.77 $WBTC ($8.07M) for 2,868.4 $ETH at a price of $2,813.

Address: 0xee7f7f53f0d0c8c56a38e97c5a58e4d321a174dc

Data @nansen_ai pic.twitter.com/yhh7IvYLLz

— Onchain Lens (@OnchainLens) January 26, 2026

WBTC is a tokenized form of Bitcoin that inhabits the Ethereum chain, so swapping it for native ETH changes how those funds can be used within decentralized finance.

The funds were moved through a public wallet tied to WLFI. This was confirmed by on-chain evidence that was circulated by data platforms.

Strategic Reasons Behind The Shift

Several reasons could explain the swap. Holding ETH gives direct access to smart contracts, staking, and DeFi tools that WBTC cannot offer on its own.

Some market watchers think WLFI may be positioning to use ETH for on-chain services, staking, or profit from future network activity.

Others suggest it could be a way to rebalance risk between stores of value and utility tokens. Reports say no single motive can be proved from the chain itself, only the movement of funds.

Reaction And Broader Signals

Traders reacted with curiosity rather than panic. Prices barely moved on the news, showing the market may have already priced in similar flows.

Smaller investors watched closely because such a swap by a high-profile, politically linked project draws attention. The wallet activity was tracked publicly, and analysts noted the timing matched a period of calmer ETH price action.

What This Could Mean For Investors

Reports note that big reallocations like this can change short-term sentiment, though they do not always lead to lasting rallies. For holders who prefer simplicity, swapping WBTC for ETH changes the way capital can be used, moving from a Bitcoin peg to native network participation.

Featured image from Unsplash, chart from TradingView