What to Know:

- Bitwise’s XRP ETF has launched on NYSE Arca with a 0.34% fee waived on the first $500M, positioning XRP as an institution-ready asset.

- XRP dropped more than 9% into the launch before recovering, with higher volumes and futures open interest indicating renewed speculative and hedging activity.

- Best Wallet Token, Bitcoin Hyper, and Ionix Chain map onto themes supported by ETF flows: self-custody, Bitcoin scalability, and AI-native infrastructure.

- These projects provide presale access and strong utility narratives but still come with early-stage risks tied to execution, exchange listings, and long-term adoption.

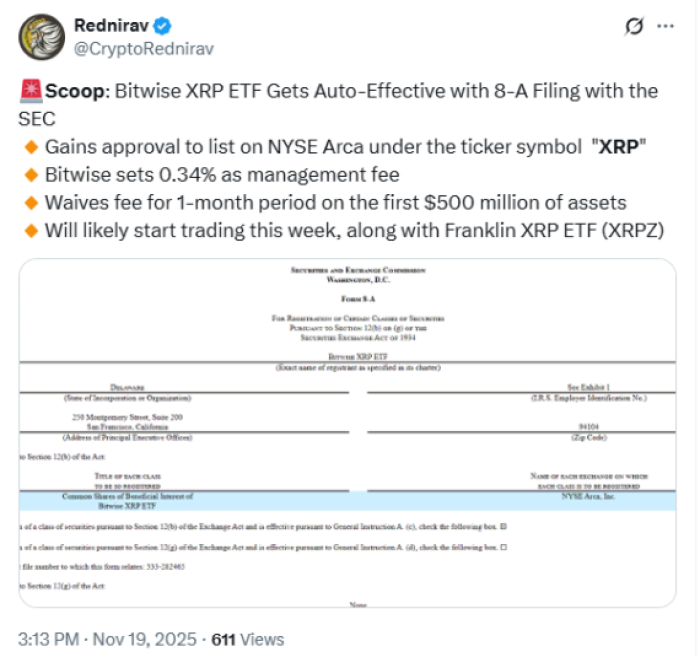

Bitwise’s spot XRP ETF is finally live on NYSE Arca under the ticker ‘XRP’, and the issuer is calling it a ‘historic moment’.

The $15B asset manager has set a 0.34% management fee and is waiving it for the first month on the first $500M of assets, an aggressive move to capture early institutional flow.

The market reaction has already been spicy. XRP dumped more than 9% to around $2 on classic ‘sell the news’ flows, then bounced back to about $2.12 as volumes jumped and futures open interest ticked higher.

That’s the ETF era in a nutshell: institutions get a cleaner wrapper, traders get more volatility to play with.

This matters beyond XRP. Spot ETFs helped normalize exposure to $BTC and $ETH; now one of the biggest payments tokens is getting the same treatment. As capital moves from blue chips into higher-beta plays, altcoins and the best crypto presales tend to ride the second wave of risk-on sentiment.

Three presales line up neatly with this shift: a wallet super-app built for self-custody, a Bitcoin Layer-2 turning ‘digital gold’ into active collateral, and an AI-native Layer-1 chasing the next infrastructure trade.

Here’s how Best Wallet Token, Bitcoin Hyper, and Ionix Chain fit into the post-ETF landscape.

1. Best Wallet Token ($BEST): Wallet Super-App For The Post-ETF Onboarding Wave

If XRP ETFs succeed, a fresh wave of non-crypto natives will end up holding digital assets for the first time. Those users eventually graduate from brokerage accounts into self-custody, and that’s exactly where Best Wallet Token tries to position itself.

Best Wallet is a live, non-custodial, multi-chain wallet with fiat on/off-ramps, portfolio tracking, and cross-chain swaps routed through hundreds of DEXs and bridges.

It already counts hundreds of thousands of users, supports major chains like Bitcoin, Ethereum, Solana, and BNB Chain, and is rolling out a debit card, analytics suite, advanced order types, and a staking aggregator.

The idea is simple: one app that feels like a trading terminal, not a barebones wallet.

Best Wallet Token ($BEST) is the access key to that stack. Holders get reduced swap and on-ramp fees, boosted staking yields, governance rights, and early ‘Stage 0’ access to new token launches inside the wallet’s launchpad.

The presale has raised over $17.23M so far, with the current stage pricing $BEST at about $0.025975 and staking yields around 76% APY for early participants. To buy $BEST and start staking, check out our guide.

Our $BEST price prediction suggests that, if the roadmap lands and exchange listings arrive in a supportive market, $BEST could potentially reach up to roughly $0.05106175 in 2026. From today’s presale level, that implies a 96% upside scenario.

If ETF flows pull more people into crypto, full-stack self-custody tools should be one of the structural winners.

2. Bitcoin Hyper ($HYPER): BTC Layer-2 Turning ‘Digital Gold’ Into DeFi Collateral

While XRP steals today’s headlines, Bitcoin is still the main liquidity engine in this market. The problem: as a base layer, it’s slow, expensive, and terrible for DeFi. Bitcoin Hyper ($HYPER) is trying to fix that without touching Bitcoin’s core security model.

Bitcoin Hyper builds a high-throughput Layer-2 using the Solana Virtual Machine. Users bridge $BTC into the network via a canonical bridge; wrapped $BTC then moves on a fast chain with near-instant finality and sub-cent fees, while settlement still anchors back to Bitcoin.

That opens the door for $BTC-denominated DeFi, NFTs, gaming, and even meme coins, all while remaining ‘Bitcoin-native’.

The HYPER presale has already crossed roughly $28M raised at a token price of $0.013305, with staking rewards at 41% APY.

There’s no private VC round in front, and on-chain data shows multiple six-figure whale tickets (including a $500K buy and a $379K purchase), which is why this sale keeps popping up on presale trackers.

Learn how to buy $HYPER to get in early.

From a valuation angle, our $HYPER price prediction put a potential 2026 high around $0.08625. Measured from the current sale level, that’s roughly 546% upside in the optimistic case.

The thesis is clean: if ETFs push more capital into $BTC, a working $BTC Layer-2 that actually lets that capital do something could be in the slipstream.

3. Ionix Chain ($IONX) — Quantum AI Layer-1 With Built-In Revenue Sharing

Where XRP ETFs reflect TradFi edging into crypto, Ionix Chain ($IONX) represents the opposite direction: crypto infrastructure leaning into AI.

Ionix pitches itself as the first AI-native Layer-1 blockchain using a proprietary Quantum AI Consensus to hit up to 500,000 TPS with sub-second finality and gas fees near $0.0005.

Under the hood it combines Proof-of-Stake with a DAG-style architecture, plus sharding, to stay scalable as usage grows.

The network is designed for AI-heavy workloads: adaptive smart contracts that optimize in real time, on-chain ML computation, and cross-chain bridges into ecosystems like Ethereum and Solana.

In other words, it’s built for the part of the market where AI and DeFi start blending, exactly the type of narrative that tends to catch fire when risk appetite returns after big events like the XRP ETF launch.

Tokenomics are tailored to keep holders plugged in. $IONX stakers can currently earn around 12% APY in the presale, while the protocol plans to distribute 15% of daily gas fees back to token holders and add up to 5% loyalty airdrops for early participants.

The presale has already raised more than $1.57M, with the current stage pricing IONX at about $0.050.

If the mainnet lands by 2026, major CEX/DEX listings go ahead around the planned $2 listing band, and the AI-chain narrative actually converts to real usage, Ionix could launch hard and climb fast.

The XRP ETF launch marks another step in crypto’s institutionalization, with Bitwise offering fee-waived exposure to XRP just as traders lean back into risk. That backdrop sets the scene for selectively hunting upside further out the curve.

Best Wallet Token targets the self-custody and tools layer, Bitcoin Hyper extends Bitcoin into high-speed DeFi, and Ionix Chain bets on AI-driven infrastructure, three very different ways to play the same shift in capital and narrative.

This article is informational only and not financial advice. Crypto presales are high-risk; never invest money you cannot afford to lose.

Authored by Aaron Walker for NewsBTC – https://www.newsbtc.com/news/best-crypto-presales-bitwise-xrp-etf-launch-best-wallet-hyper-ionix