Bitcoin can’t catch a break for the past several days as the bears seem in complete control of the market, staging another nosedive to a fresh multi-month low of just under $92,000.

Ethereum has also dipped to a crucial round-numbered support, and the liquidations are on the rise due to excessive leverage used by traders.

It wasn’t that long ago when BTC stood firmly above $100,000. In fact, less than a week ago, it had just jumped past $107,000 following some positive developments on US soil.

However, that was short-lived, and the subsequent rejection and correction have been quite violent. Bitcoin plummeted to a five-digit price territory last Thursday and has not been able to stage any sort of recovery.

Just the opposite, the hits keep on coming, and the latest took place minutes ago when it dipped below $92,000. This is the lowest price tag it has seen since April 24, making it a seven-month low.

What’s interesting and different about the ongoing crash is the fact that there’s no evident culprit behind it. Unlike previous occasions, such as industry blowouts, global pandemics, or macro uncertainty, this correction appears to be driven by excessive leverage, as explained by the Kobeissi Letter earlier.

Moreover, the analysts determined that BTC has entered a new structural bear market, and the landscape has only worsened since then.

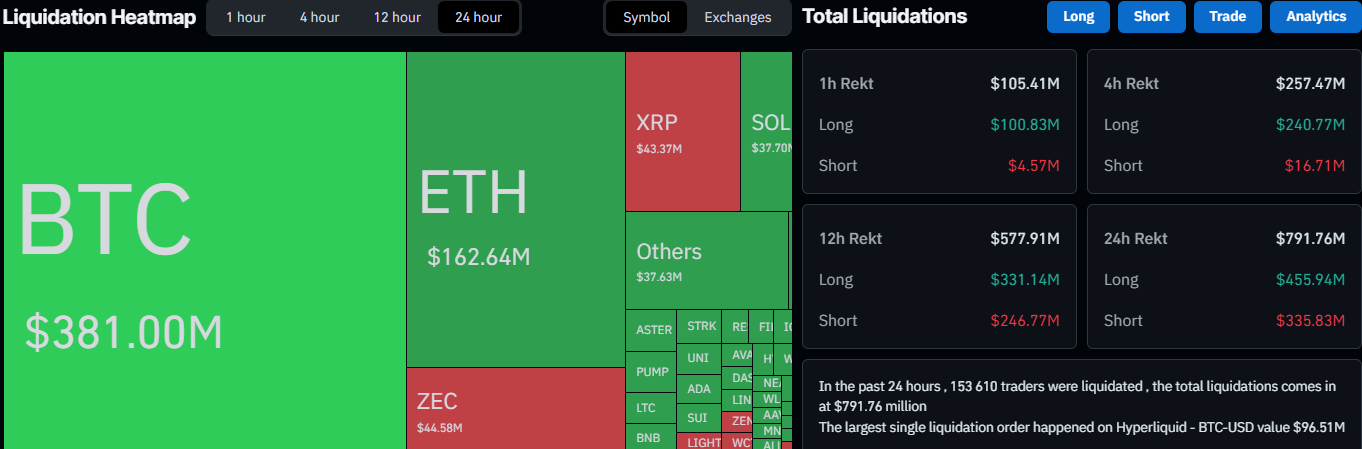

ETH is in no better shape as it dipped below $3,000 minutes ago as well. Ethereum is down by more than 15% weekly and over 22% in a month. Most other altcoins are in a dire state as well, with XRP dropping by 3.6% daily and SOL plunging by over 5%.

Naturally, the high levels of leverage used by traders have harmed a significant number, with more than 150,000 such market participants wrecked daily. The total value of liquidated positions has risen to almost $800 million within the same timeframe.

The single-biggest wrecked order was a whopping one. It took place on Hyperliquid and was worth $96.51 million, data from CoinGlass shows.

The post Bitcoin Crashes Below $92K, Ethereum Under $3K—Liquidations Surge to $800M appeared first on CryptoPotato.