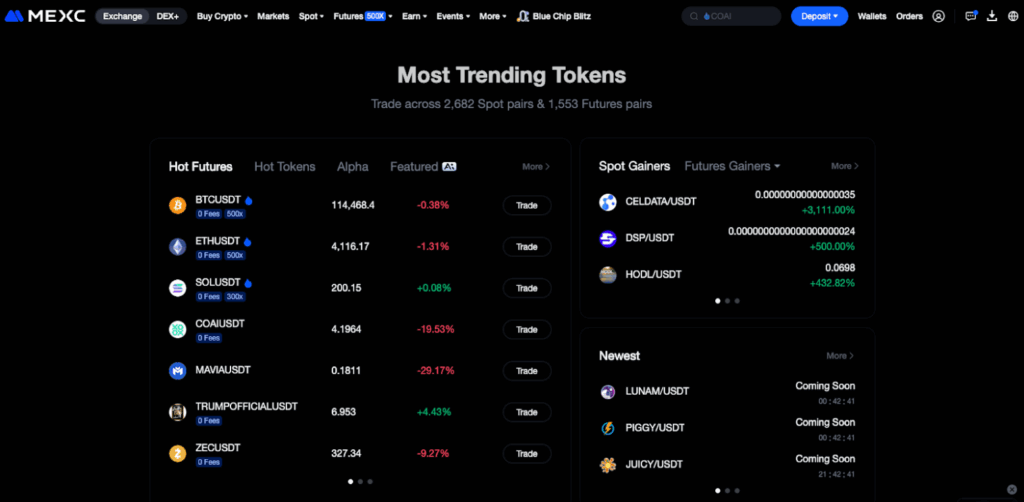

MEXC is one of the more popular cryptocurrency exchanges in 2025 and is primarily focused on trading altcoins. It is known for its fast listing processes, broad support for different coins and a range of different products, creating a fully-fledged ecosystem for traders and investors.

The following MEXC review assesses its core features and product offerings and answers one of the most pressing questions: is MEXC a safe crypto exchange?

Introduction

What does this review cover?

In the following MEXC review, I take an in-depth look at the platform, which has turned into one of the more popular global cryptocurrency exchanges, especially for users looking to trade altcoins. I’ll cover its trading features, supported assets, security measures, and overall user experience. By the end of it, you will know if MEXC is a safe crypto exchange and if it’s suited for your personal trading needs, as well as how it compares to some of the major platforms like Binance and Bybit.

Who is this review for?

The review is suitable for both new and experienced traders who want to obtain a deeper understanding of whether MEXC fits their trading needs. This review will ultimately help you decide if MEXC is the right exchange for you.

Quick verdict – key highlights and drawbacks

- Huge selection of altcoins (1,500+)

- Up to 500x futures leverage

- Zero maker fees for spot & futures

- Advanced features: Copy Trading, DEX+, Launchpad

- Fast registration and responsive interface

- Restricted in the US, Canada & several regions

- Thin liquidity on some small-cap pairs

- Limited fiat support compared to top-tier exchanges

- Mixed customer support feedback

What is MEXC: Company Background

MEXC was founded in 2018 and has since positioned itself as “Your Easiest Way to Crypto.” I’ve first noticed and used the exchange in 2020, and it’s safe to say that it has come a long way since then. It now serves millions of users across more than 170 countries. It offers a robust set of features and has transitioned beyond just a crypto exchange.

Much like some of the bigger brand names, MEXC now boasts a fully-fledged ecosystem with its native cryptocurrency, as well as additional features such as launchpads, copy trading, fiat on-ramps, and more that I will cover in detail in this review.

One thing has always been clear, though – MEXC has always emphasized altcoin trading. This is supported by the fact that it’s constantly amongst the first centralized exchanges to list new altcoins.

The platform also lets users trade with up to 500x leverage on certain USDT-M perpetual futures, catering to those seeking extreme risk parameters.

Security: Is MEXC a Safe Crypto Exchange in 2025?

Security measures

MEXC features a layered security system designed to protect users’ accounts and funds. Among the supported measures are the mandatory two-factor authentication (2FA), strong password control, and device login history monitoring.

In addition, the platform uses a combination of hot and cold wallets, SSL encryption and anti-DDoS infrastructure, as well as multi-signature wallets to safeguard user assets and their trading operations.

Its security framework is described as “prevention -> monitoring -> response -> protection.”

Regulatory status in key jurisdictions

While MEXC is clearly emphasizing its global presence, its regulatory status varies by jurisdiction.

According to its official website, MEXC does not provide services to or accept sign-in and trading applications from:

Canada, Cuba, Iran, Mainland China, North Korea, Russia-controlled areas of Ukraine, Singapore, Sudan, and the United States.

Moreover, specifically to the US, the exchange also notes:

This prohibition extends to all US territories and dependencies, including the US Virgin Islands, US Minor Outlying Islands, and American Samoa. Residents of these regions cannot register, trade, or access any MEXC services regardless of the domain or access method used. The restriction applies to both individual and institutional accounts.

Track record

On the one hand, MEXC publishes regular security- and reserve-oriented transparency data. For instance, it has bi-monthly Proof of Reserves audits, independent audits by security firms like Hacken, finding no critical or high-risk vulnerabilities in the web platform or the mobile app, which reinforces its standing as a secure crypto exchange.

On the other hand, there are some regulatory controversies. For instance, the Financial Conduct Authority in the UK has issued a warning that “MEXC Global Ltd,” is not authorized to operate in the country. At the same time, the Securities and Futures Commission in Hong Kong also flagged it as operating without a licence.

That said, from a technical standpoint, MEXC doesn’t seem to have any security challenges, but you might encounter some regulatory hurdles depending on your jurisdiction.

In 2025, MEXC was caught up in a broad public controversy over freezing customers’ funds. CSO Cecillia Hsueh has taken a very proactive stance, and the exchange has worked to both release funds and to improve its internal risk-measuring systems.

Insurance funds, proof of reserves

MEXC offers a number of transparency and protective mechanisms. It has an Insurance Fund Account, which is designed to cover situations when a leveraged position’s loss exceeds its margin so that the winning counterparties are still paid.

The exchange is also publishing Proof of Reserves data publicly, showing that user assets are fully backed with reserve above 100% for some of the major cryptocurrencies such as BTC, ETH, USDT, and USDC.

In addition, MEXC has a $100 million “Guardian Fund” – an initiative that’s designed to protect users from large-scale security threats.

Bottom line: Is MEXC a Secure Exchange?

From a technical standpoint, MEXC is a secure crypto exchange that has never been hacked. However, from a legal perspective, you face regulatory hurdles depending on your jurisdiction.

Supported Markets & Features

Spot trading

Spot trading allows you to purchase and sell cryptocurrencies with immediate settlement and full ownership of the asset.

MEXC supports a very wide range of trading pairs, including but not limited to:

- Bitcoin (BTC)

- Ether (ETH)

- Ripple (XRP)

- Cardano (ADA)

- Binance Coin (BNB), and much more.

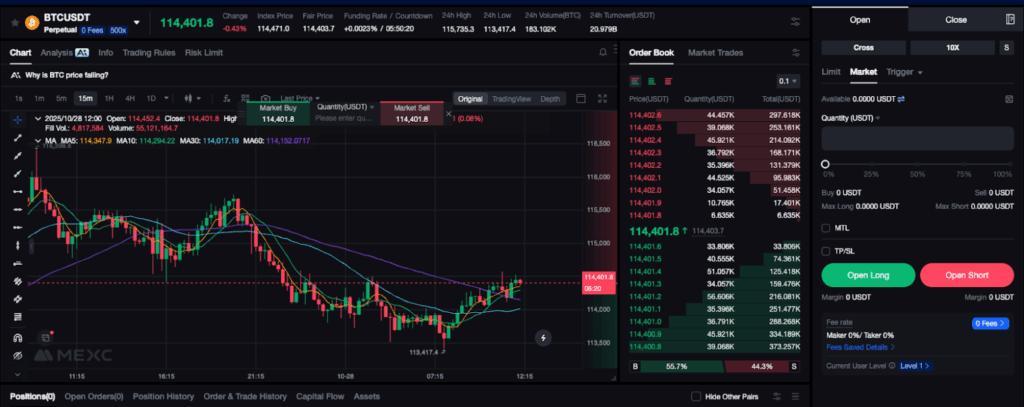

The overall interface is intuitive and familiar and is built around key components such as the order book, the candlestick chart area, the order panel, the trading-pair selection area, the recent trade feed, and the status area of your current orders. This is what it looks like:

Futures

MEXC also supports a full derivatives suit with its futures market. Here, users can trade perpetual contracts, which means they trade synthetic assets rather than owning the underlying ones. This, however, allows them to use leverage and advanced order types such as trigger orders, trailing stops, and more.

The futures platform supports both USDT-margined (USDT-M) and Coin-margined (COIN-M) perpetual futures, as well as cross and isolated margin modes to cater to more experienced derivatives trader.

In my experience, the interface is easy-to-use and it brings a familiar feeling to it. You have to be careful with liquidity, though. Because MEXC is quick to list new altcoins, some of them have very thin order books and if you are a high-volume trader, your orders might incur significant slippage because of insufficient liquidity.

This is what the derivatives trading interface looks like:

Copy trading

Aimed at the less experienced users, MEXC’s copy trading feature enables you to replicate the trades of more seasoned and profitable traders automatically.

I can see how this feature broadens the appeal of MEXC, allowing users to benefit from professional (supposedly) insight while retaining the ability to review risk parameters and performance. The selection dashboard is comprehensive, but a word of caution: be careful when selecting the traders you want to copy, as their trading style and positioning might not align with your risk appetite and portfolio size.

You should also carefully examine their recent trades to check where the ROI and PnL stats are coming from. For instance, the trader might have taken one profitable trade and several losing ones, which, given inappropriate sizing, might have a different impact on your account.

I wouldn’t advise you to size up with copy trading because there’s always the possibility that accounts with a huge following can open counter-trading positions on different exchanges to profit from their followers.

MEXC Fees

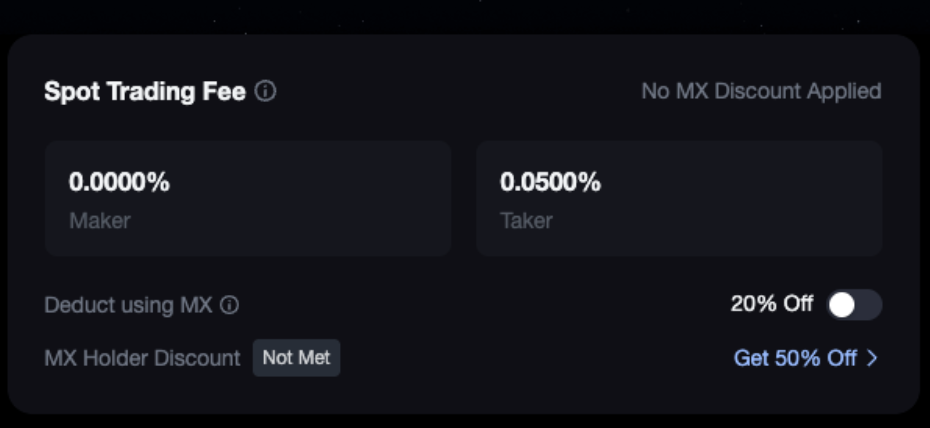

MEXC Spot Trading Fees

Unlike the majority of centralized exchanges, MEXC takes an interesting approach and forfeits market-making fees for its spot pairs. This can be a significant discount to those of you who prefer trading with limit orders.

Maker fee: 0.0000%

Taker fee: 0.05%*

*You can get up to 20% off your taker fees if you choose to pay them with MX tokens, while also enjoying additional tier-based discounts if you hold MX tokens.

MEXC Futures Trading Fees

Similarly to spot trading, futures traders can also enjoy no fees for market makers.

Maker fee: 0.000%

Taker fee: 0.020%*

*You can get up to 20% off your taker fees if you choose to pay them with MX tokens, while also enjoying additional tier-based discounts if you hold MX tokens.

MEXC Deposit/Withdrawal Fees

Deposit fees: There are no fees for depositing funds into MEXC.

Withdrawal fees: The withdrawal fees depend heavily on the network that you select and its current load. More information can be found here.

Platform & User Experience

Web platform

Overall, I find using MEXC to be enjoyable. The interface is relatively intuitive – the layout itself balances functionality with efficiency. I will say this – if you are an experienced user who has previously tried other popular exchanges, you will find absolutely no challenges navigating through MEXC. On the other hand – if you are just starting out, the abundance of features might be slightly overwhelming, but it doesn’t take long to get used to it.

In my experience, all the tools I tested worked as intended, the charts were loading fast, and I didn’t feel like I was “fighting” the UI.

That said, I did notice a couple of minor hiccups when market volatility spikes. On lower-volume altcoins, the charts updated slightly more slowly, and latency increased. This has happened on a lot of other exchanges and even big names like Binance and Bybit.

Mobile app

One of the first things I noticed when I switched to the Mobile App (as an iPhone user) was how much of the desktop experience it brought to my phone.

I was able to do pretty much everything a mobile user would—place orders, monitor charts, execute trades, track portfolio changes, and more. It’s okay on the battery usage, but of course, that would heavily depend on what phone you use.

MEXC’s mobile app is available for Android and iOS.

For me, personally, the application does the job. You wouldn’t be doing the bulk of your heavy trading on a mobile app, of course, because it does have some natural limitations. For example, it’s hard to trade more than one pair at a time or to execute orders as quickly as you would on a desktop computer.

Does MEXC Require KYC?

The short answer is yes, MEXC requires KYC for most of its platform features, but there are layers to that.

Here’s the brief:

- MEXC requires KYC to withdraw more than 1,000 USDT per day, but basic trading remains open without verification. This also depends on your region, so you might be required to KYC nonetheless.

- MEXC KYC requirements include a government-issued identity document like an ID card – this would suffice for Primary KYC (80 BTC limit). Facial verification is necessary for Advanced KYC – 200 BTC limit.

- KYC verification is typically processed within 24 hours.

Customer Service & Support

Customer support at MEXC is extensive. There’s a number of different self-service features, that you can find useful in certain situations.

If you wish to contact a live customer support agent, you will have to either submit an inquiry or email them. There’s also online support available through a chatbot.

Trustpilot gives MEXC a low score on their customer support – 1.8 (out of 5) based on around 1100 reviews. This tends to be the norm – most of the centralized cryptocurrency exchanges have very low scores on Trustpilot. This is usually because people are less incentivized to leave a positive review rather than to express frustration, but it’s also important to keep into account.

Unique Features

DEX+

DEX+ brings forward a hybrid on-chain trading venue that’s designed to blend in the usability of centralized exchanges with the versatility of supported assets from decentralized exchanges (DEX).

Users are able to trade more than 10,000 tokens across a variety of different blockchains, access aggregated liquidity from numerous DEXs, and take advantage of streamlined execution within the MEXC account interface.

Naturally, DEX+ supports external wallet login and also offers “wallet as identity” to streamline Web3 adoption. The 1% trade fee is worth pointing out as well.

Meme+ trading zone

As I explained in the beginning, MEXC has long positioned itself as an altcoin trading exchange and the Meme+ Trading Zone is just another confirmation of it. This is a dedicated area for trading trending on-chain meme coins curated by MEXC.

The purpose of this product is to allow users to access early-stage meme coin opportunities without having to use a Web3 wallet and a decentralized exchange. Keep in mind, though, that a lot of these trend to zero and are highly volatile.

Launchpad

The Launchpad is a token-issuance platform. It gives users the chance to access projects at discounted prices.

There are two key types of events. The first is Early Access, which offers first-mover opportunities. The second one is the Discount Buy, which lets users buy some of the more mainstream tokens at discounted prices.

To take part, you must have completed the full KYC verification. You can subscribe with supported tokens, including MX, USDT, and more.

Demo accounts

If you want to start trading futures and you have no prior experience, I strongly suggest that you take a look at the Demo trading option. You can find it under the “Futures” dropdown toward the bottom.

This is a great way to test your strategies, to get a hang of the overall trading experience on the platform, to understand the logic behind certain order types, and more.

According to an official blog post on the MEXC website, the demo trading feature replicates live trading 100%:

MEXC Futures Demo Trading fully replicates the live trading interface, functions, and market data, covering major pairs such as BTCUSDT. This allows users to practice in an environment that closely mirrors live markets, ensuring a seamless transfer of skills to real trading.

Native Token (MX)

The native token issued by MEXC carries the ticker MX. It is based on the ERC20 token standard and operates on the Ethereum blockchain. It serves multiple functions within the exchange’s ecosystem.

For instance, by holding MX, you can unlock certain platform benefits. These include, but are not limited to:

- Discounted trading fees

- Participation in token sales (through the Launchpad)

- Eligibility for airdrops, and much more.

Frequently Asked Questions (FAQs)

Is MEXC safe and legit?

Yes, MEXC is generally considered a safe cryptocurrency exchange. It has never been hacked. However, there are official regulatory statements regarding its operations in certain jurisdictions that users must keep in mind.

Can US / Canadian users trade on MEXC?

No. Both the United States and Canada are on the MEXC restricted country list, and users from these countries cannot register an account.

How do I withdraw crypto from MEXC?

Crypto withdrawals on MEXC are very straightforward – the exchange supports all of the popular networks, and the withdrawals are smooth and quick.

MEXC Review 2025: Final Verdict

If you’re looking for an exchange to trade new and up-and-coming altcoins, MEXC is usually among the first exchanges to list trending altcoins. The interface is familiar, intuitive, and easy to use. Notably, it lacks the order-book depth of some competitors on major pairs, but since the exchange’s focus has always been altcoins, that’s understandable.

Despite its clean track record on security breaches, I would err on the side of caution, especially if you are in a jurisdiction where the regulator has flagged the exchange. Despite the issues with frozen customer funds in 2025, it appears that the exchange is moving forward and working to improve its policies. It would take more time to properly assess whether this will continue to be the case. As with every other centralized cryptocurrency exchange, it’s always more reasonable to keep funds that you only use for trading purposes.

Other than that, MEXC offers a seamless trading experience, a wide variety of supported altcoins, a multitude of unique features, and more.

The post MEXC Review 2025: Is MEXC a Safe Crypto Exchange? appeared first on CryptoPotato.