Pi Network’s native token went on the run in the past couple of weeks, skyrocketing from its October 10 all-time low of $0.172 to roughly $0.29 before it settled at around $0.25 as October closed. This impressive rally came after months of prolonged correction and several positive developments in the Pi Network ecosystem, such as new updates, features, and AI implementations.

All eyes are now on November as the year is coming to a close, and the question we asked ChatGPT is whether PI has the ability to continue its recent run and double down on its price recovery attempts.

Yay or Nay in November?

Before it made its predictions for the upcoming 30 days, the AI chatbot outlined the two reasons behind PI’s 50% surge in late October: “renewed community activity (AI and utility-app pilots) and a pickup in off-exchange trading volume.”

It remains relatively bullish on the asset for November, placing a 60% “base case” that it will keep climbing, slowly and gradually. It noted that in this most likely scenario, its current price level would be the lower boundary of a broader range between $0.24 and $0.34.

“Modest continuation as ecosystem headlines keep interest alive but liquidity remains thin,” it described this scenario.

Those hoping for a more sustainable and impressive increase, one that can send PI beyond $0.40, received a 25% chance from the AI solution. Such a bullish case would be possible if the token breaks the $0.35 resistance following listings on new exchanges or additional and more tangible improvements within the ecosystem.

ChatGPT’s bear case (15% probability chance) envisions another drop below $0.20 and possibly retesting the ATL if “hype fades and no network-progress news lands before mid-month.”

What to Watch

The popular AI chatbot outlined several factors that can influence PI’s price in the next month:

-

App-ecosystem traction – new Pi-based apps or AI integrations could sustain the recovery.

-

Liquidity & listings – volumes remain small and mostly OTC; broader exchange support would be the single biggest bullish catalyst.

-

Broader market mood – a stronger BTC/alt recovery this month would amplify any upside in PI.

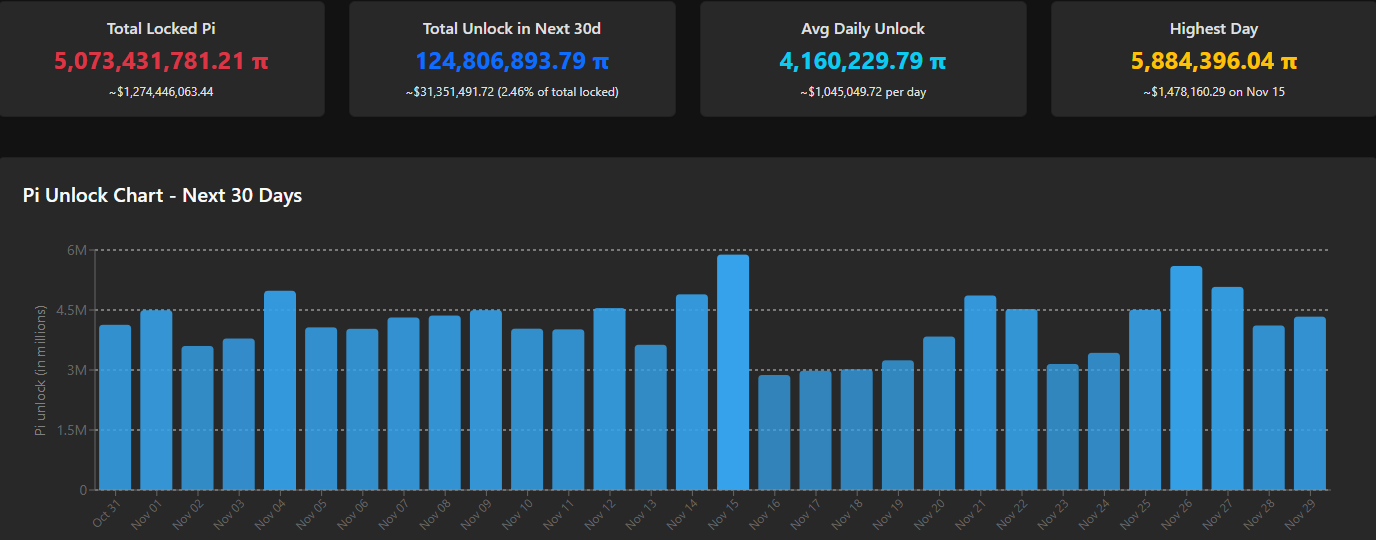

In addition, it outlined the token unlock schedule, which shows the number of coins to be released in the following month. It could be used to get a broader perspective on whether the immediate selling pressure from investors awaiting their tokens could ease or increase.

Current data from PiScan shows that the average daily unlock is around 4.160 million tokens, which is nowhere near as high as 8-9 million during the summer. As such, this could ease the immediate selling pressure and allow the asset to stabilize in November as predicted above.

The post Will Pi Network’s (PI) Price Recovery Continue in November? ChatGPT’s Bull vs Bear Scenarios appeared first on CryptoPotato.