Ethereum has staged a notable rebound from the $3.4K capitulation low, reclaiming ground above the psychological $4K level. While the move marks a strong recovery, ETH remains capped beneath key resistance zones, signalling that this rebound is an early stage of structural repair rather than a confirmed bullish continuation.

Technical Analysis

By Shayan

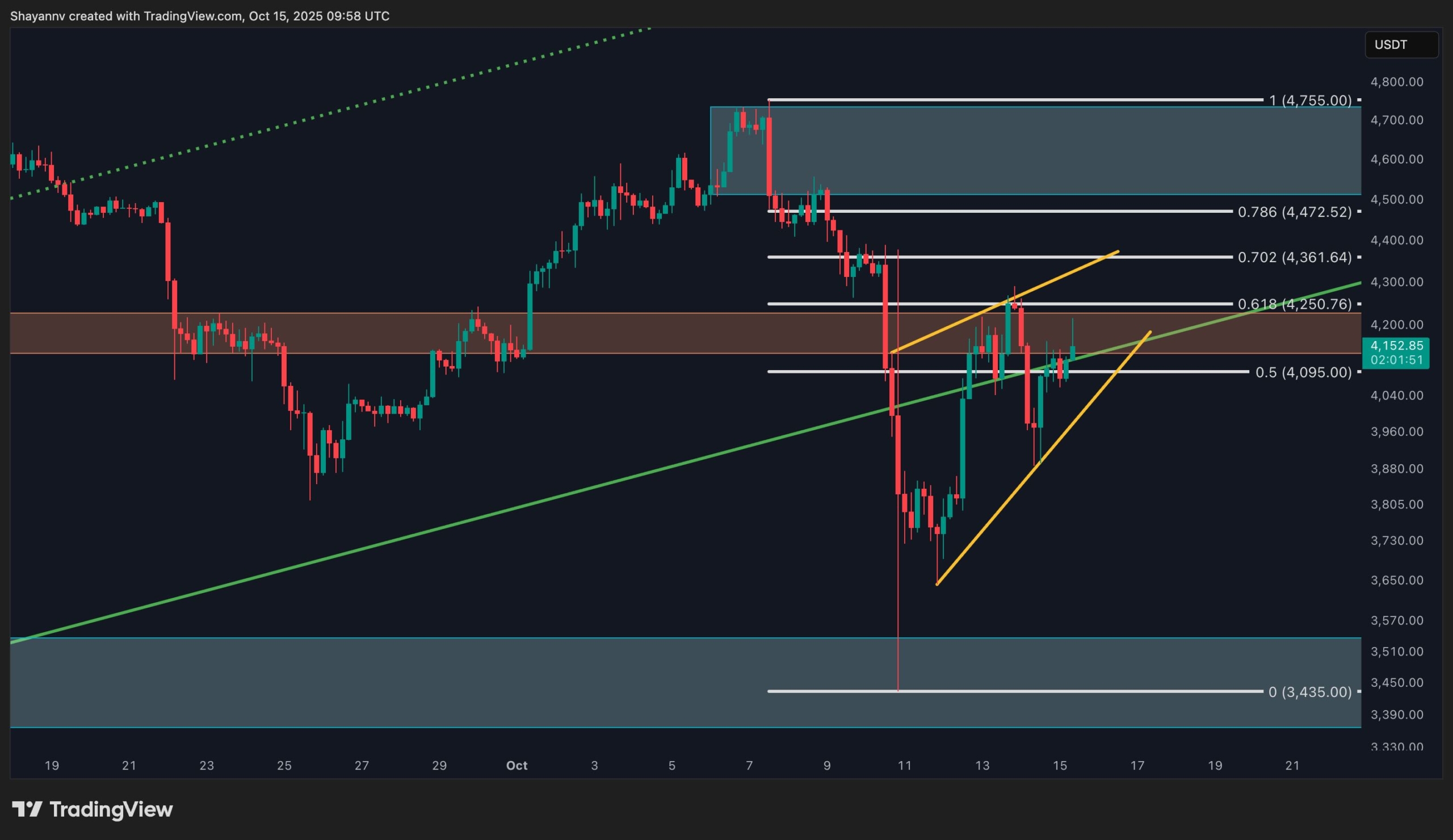

The Daily Chart

On the daily timeframe, Ethereum has recovered from the $3.4K–$3.5K demand zone, propelling the price back above both the 100-day moving average ($4K) and the channel’s previously broken lower trendline. This surge has been supported by a bullish RSI divergence, indicating waning downside momentum and suggesting that sellers are losing control after the recent capitulation.

The price action has since reclaimed the channel’s lower boundary, now acting as dynamic support, and is consolidating above this reclaimed level. However, the structure remains fragile. Sustained acceptance above $4.3K is essential to reestablish a bullish bias and open the path toward the $4.6K–$4.7K supply zone. Conversely, a drop back below $4K could invalidate the recovery and expose the $3.6K–$3.4K liquidity pool for another test.

The 4-Hour Chart

The 4-hour structure reveals Ethereum forming a rising wedge pattern following its sharp V-shaped rebound from the $3.4K low. The asset is now trading near the 0.618 Fibonacci retracement zone around $4.25K, which overlaps with the former breakdown area ($4.2K–$4.3K), making this a key decision point for short-term direction.

A breakout above $4.3K would invalidate the wedge structure and confirm bullish continuation toward $4.45K–$4.7K, aligning with the daily supply region. On the other hand, a breakdown below the wedge could trigger renewed weakness, sending Ethereum back toward the $3.8K–$3.4K demand range. Momentum remains cautiously constructive, but with volatility compressed inside the wedge, a directional expansion is likely imminent.

Sentiment Analysis

By Shayan

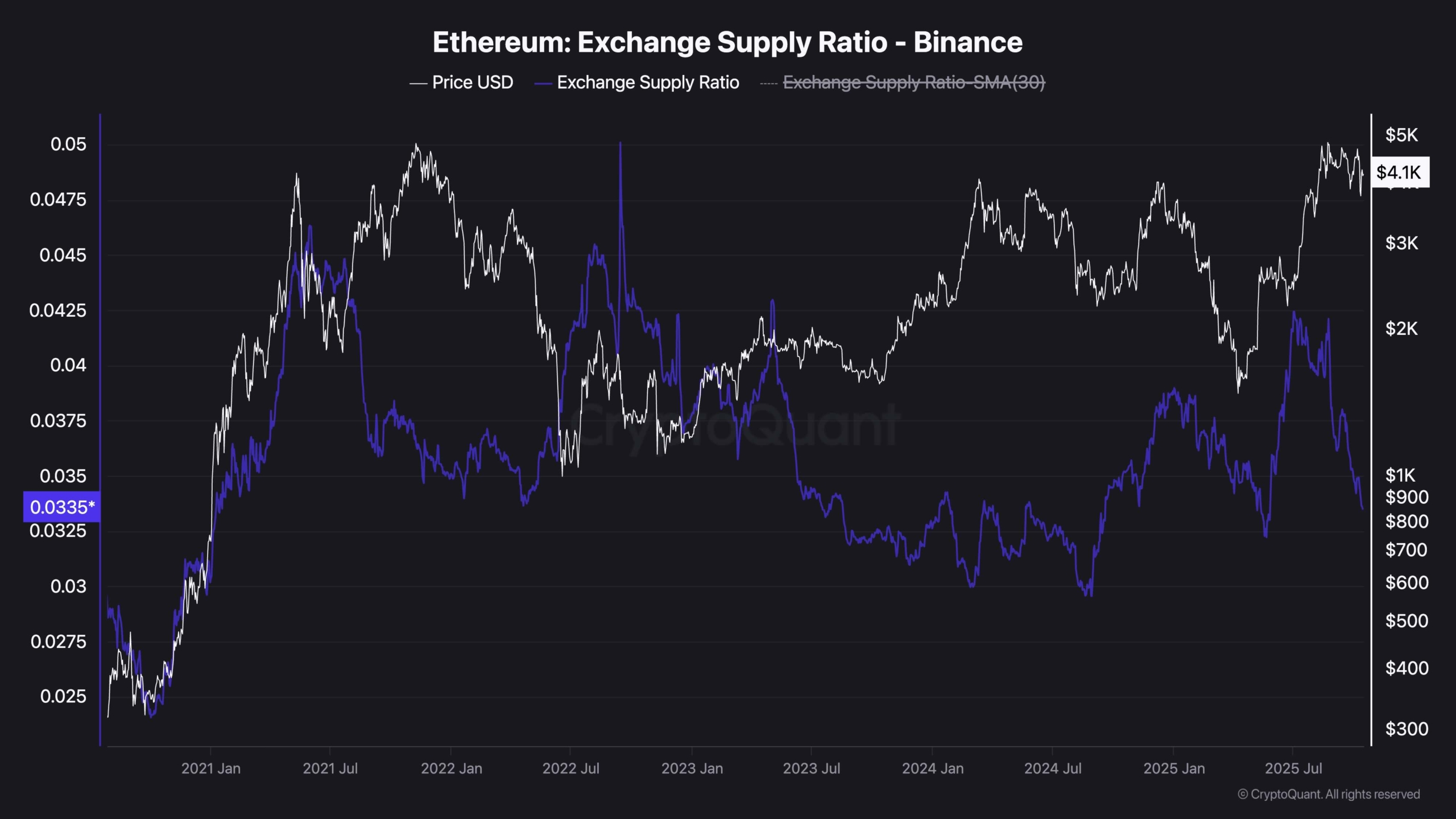

On-chain data from Binance, the largest Ethereum trading platform, shows a sharp decline in ETH’s exchange supply ratio, which has fallen to 0.33, approaching its lowest levels since May. This drop follows a brief uptick in exchange balances during the period when Ethereum was stabilizing around $4K.

The falling exchange supply ratio indicates that holders are withdrawing ETH from exchanges into self-custody or cold wallets, a behavior widely viewed as bullish. Fewer coins held on exchanges mean lower immediate selling pressure and a tightening of available liquidity, setting conditions for a potential supply squeeze if demand strengthens.

This trend suggests that Ethereum’s recovery is not merely technical, but underpinned by genuine on-chain accumulation. The shift toward holding behavior by both retail and institutional participants reinforces the idea of a structural demand base forming beneath current price levels.

If this withdrawal trend persists and technical confirmation occurs with a decisive breakout above $4.3K, Ethereum could be poised for a sustained mid-term rally, supported by shrinking exchange liquidity and strengthening market fundamentals.

The post Ethereum Price Analysis: ETH Still in Danger Below Critical Resistance Levels appeared first on CryptoPotato.