This Friday, we examine Ethereum, Ripple, Cardano, Binance Coin, and Hyperliquid in greater detail.

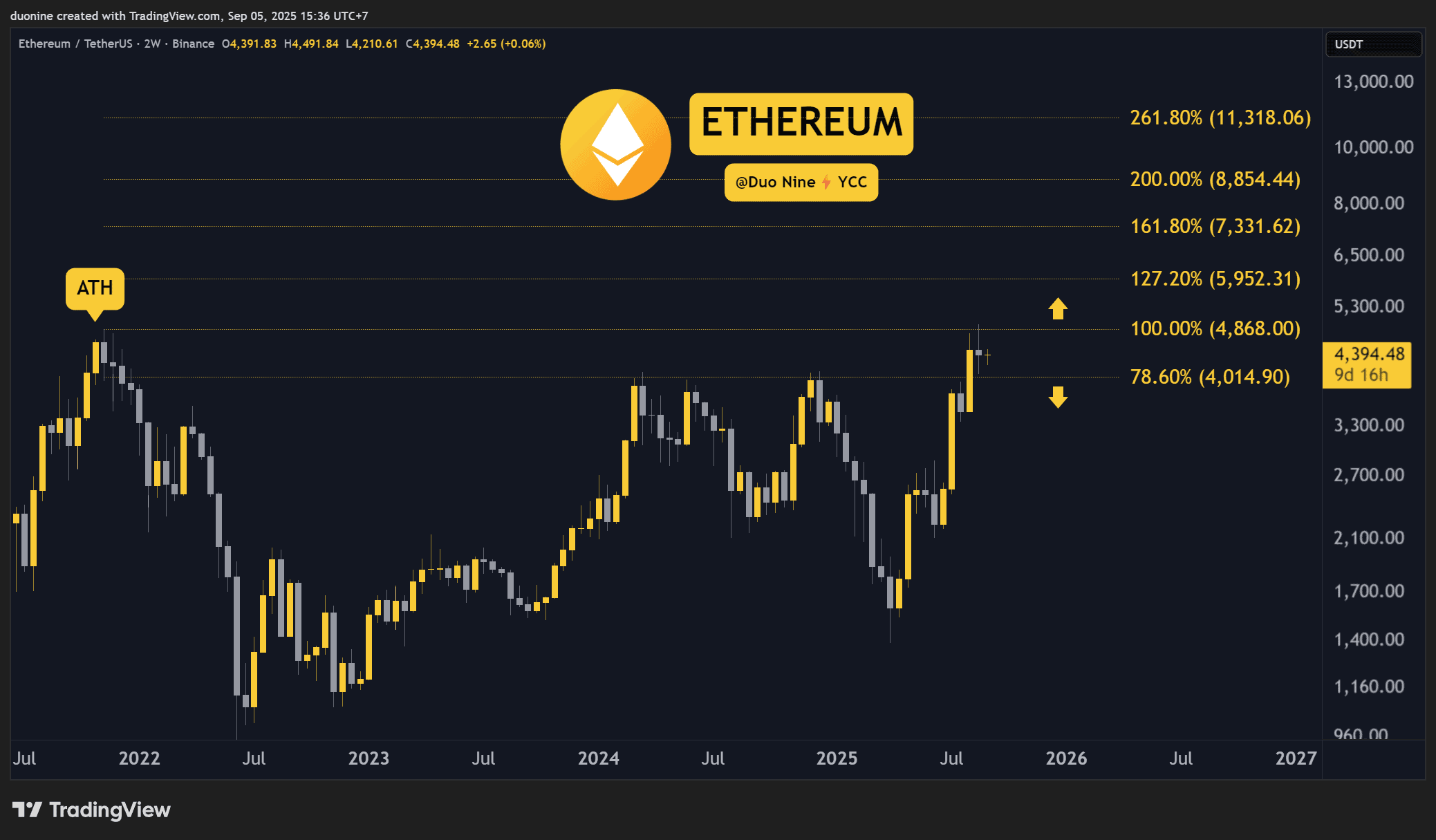

Ethereum (ETH)

Ethereum continued to move sideways, with its price only 1% higher than last week. This flat trend is characterized by a falling volume and low volatility. However, this is unlikely to last.

The most important resistance is found at $5,000, and the price has already tested the key support at $4,000. Since mid-August, Ethereum has remained stuck in this large range as buyers and sellers battled for dominance.

Looking ahead, this cryptocurrency appears to be consolidating after a significant rally over the summer. Once this pause is over, buyers have a good chance to regain control and take ETH into price discovery beyond $5,000.

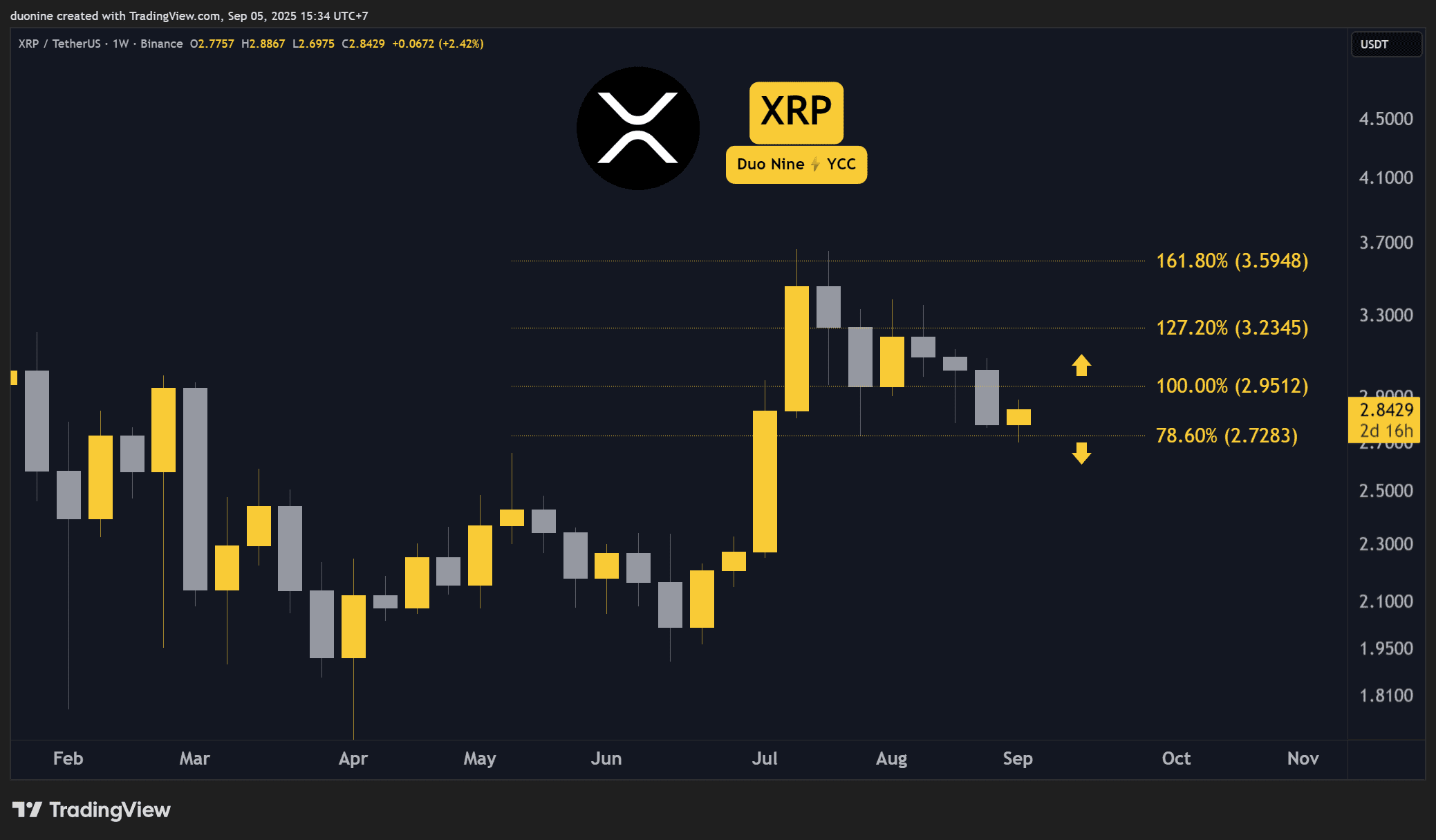

Ripple (XRP)

XRP remains in a downtrend and has formed a large descending triangle with a base of support at $2.7. As long as this key level holds, thе ассет has a good shot at a recovery and possible renewed rally.

The price closed the week with a modest 1% loss, which is not significant as long as the key support holds. However, it does signal that market participants are hesitating here and are waiting for a decisive breakout in the price action.

Looking ahead, XRP may see volatility return soon since the price appears primed to escape its descending triangle. With pressure building up, we will soon find out if sellers or buyers come on top in the days to come.

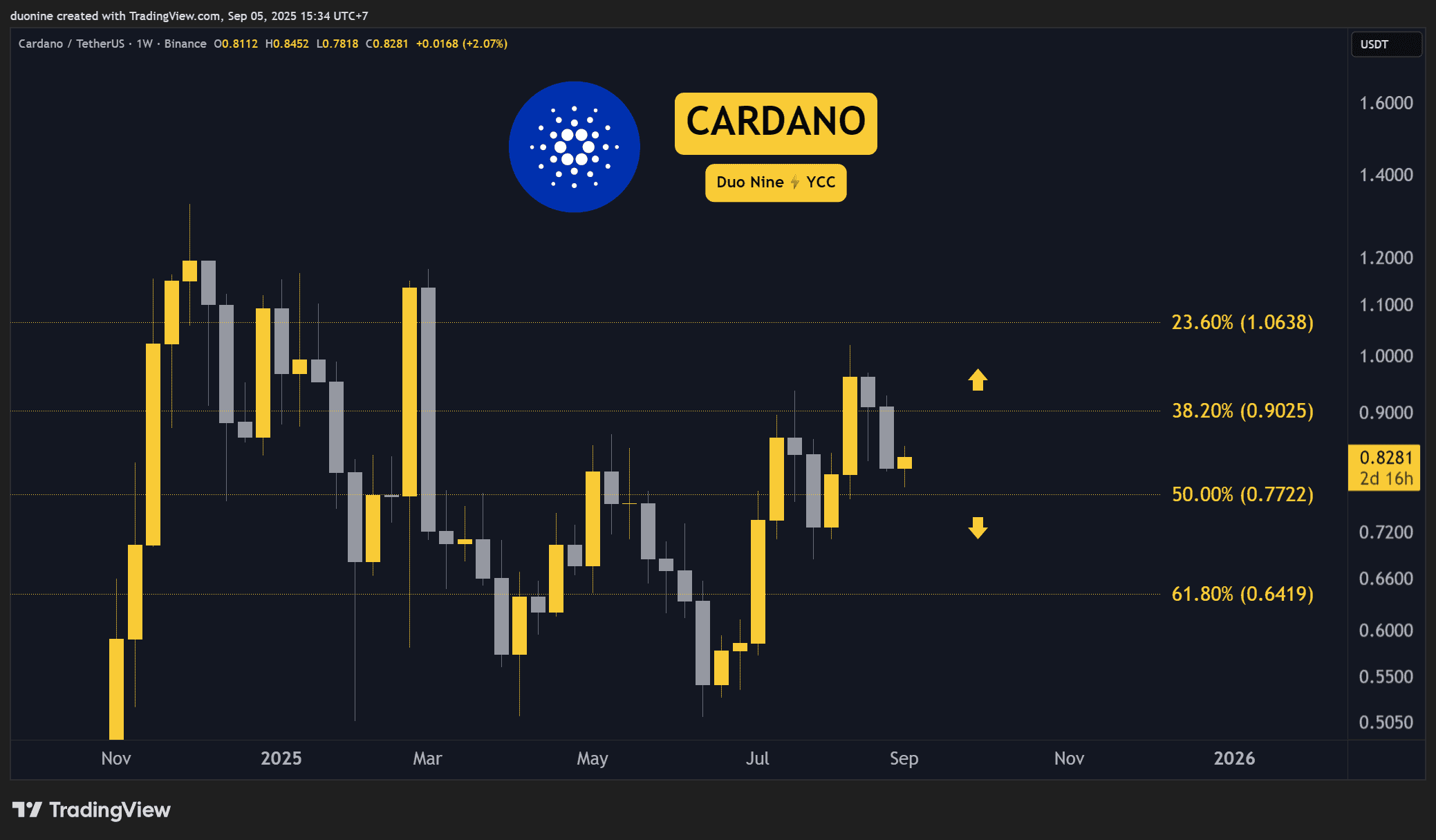

Cardano (ADA)

Cardano may have bottomed at the $0.78 key support, and buyers appear keen to make higher lows. Once that is confirmed, this cryptocurrency may try again to reach the resistance at $0.90, which rejected it in the past.

ADA also closed the week with a modest 1% gain as it moved sideways above the key support. Volume continues to fall since mid-August and explains the low volatility of the past few weeks.

Looking ahead, the bulls may attempt to push ADA into a rally and reclaim the $0.90 resistance. If they are successful, Cardano’s token will have a new chance to move above $1 afterwards.

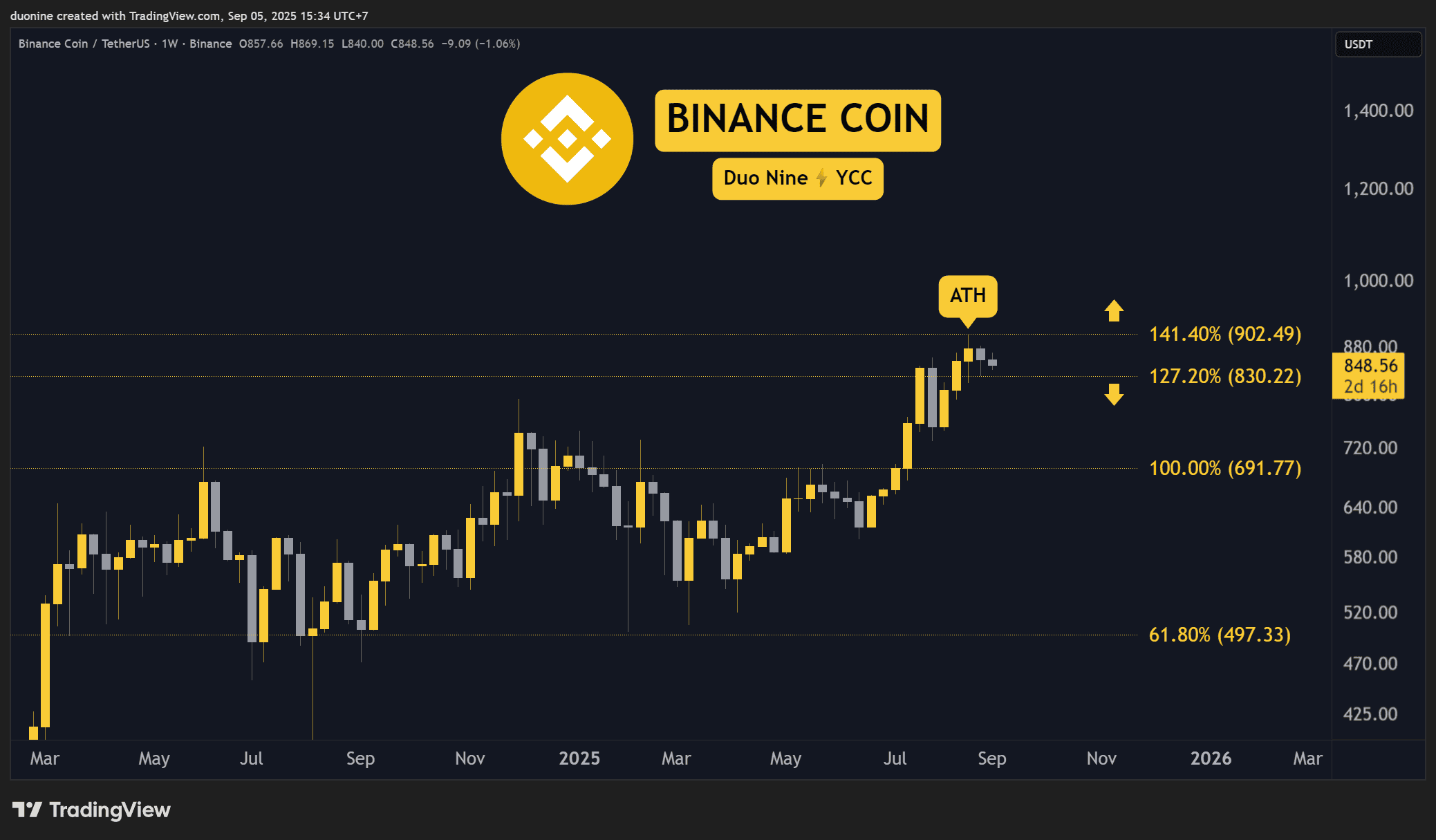

Binance Coin (BNB)

BNB has also been flat in the past week with a similar price to our last update. Nevertheless, as long as the price consolidates above the support at $830, the asset has a good shot at moving higher later.

The key resistance is found at $900 and is also the current all-time high achieved back in August. If buyers keep BNB above the key support, a test of the ATH level becomes likely in the near future.

Looking ahead, Binance Coin has a good chance to hit $1,000 in 2025. That can happen as soon as the $900 resistance falls and places BNB as one of the few altcoins to make consistently higher highs this year.

Hype (HYPE)

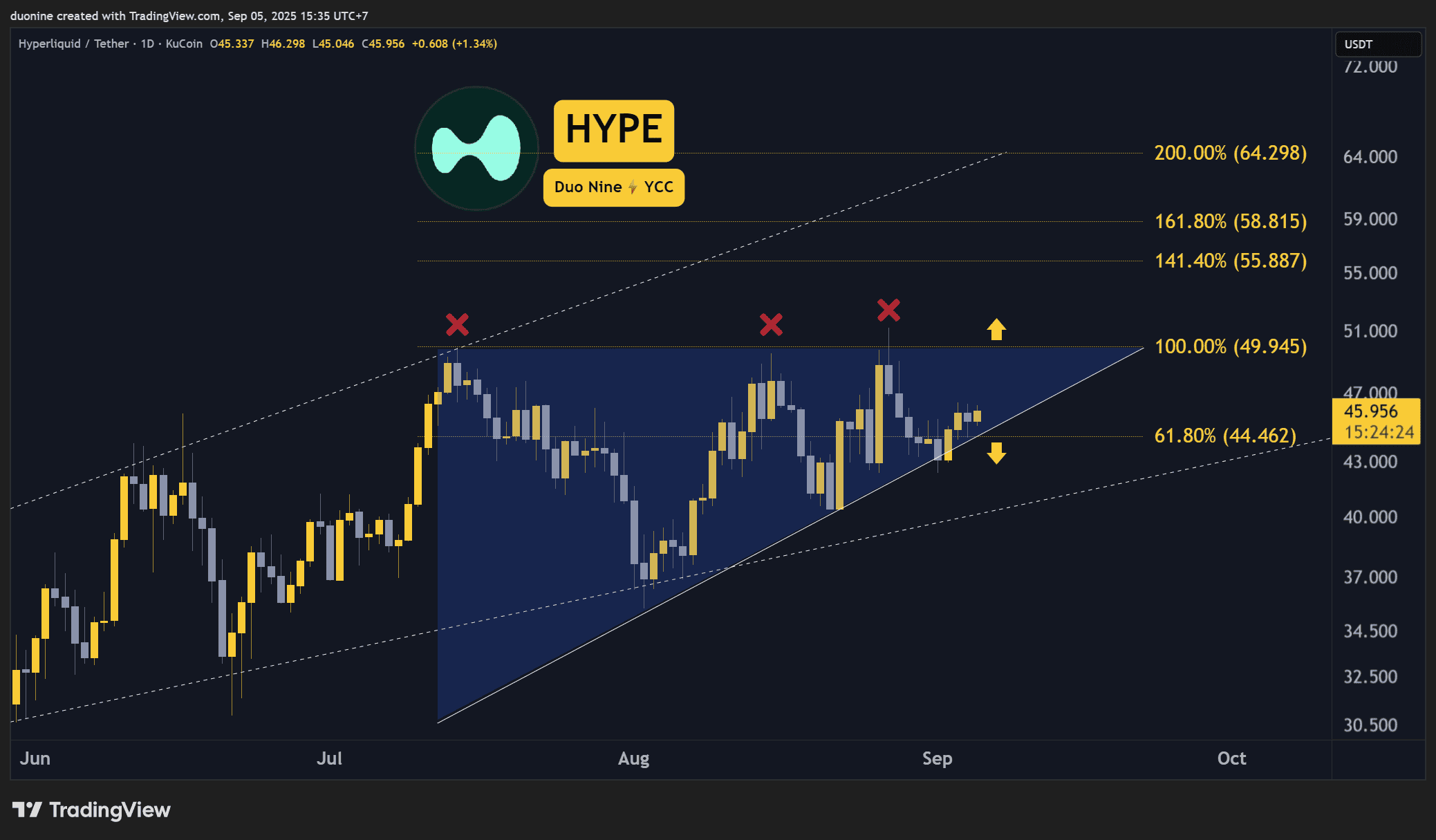

HYPE is up by 5% this week and managed to keep its price above the support at $44. Even so, the bullish momentum over the past few months has decreased, especially because the price was rejected by the $50 resistance three times to date.

It is critical for this cryptocurrency not to lose its key support because any weakness there would encourage sellers to return. At the time of this post, the price is still moving sideways between $50 and $44, which can be interpreted as consolidation.

Looking ahead, HYPE is about to make a key decision by mid-September as its time within this large ascending triangle (in blue on the chart) comes to an end. The price will likely break away; the question is in what direction.

The post Crypto Price Analysis September-05: ETH, XRP, ADA, BNB, and HYPE appeared first on CryptoPotato.