Ethereum is trading near $4.3K, testing critical supports inside its long-term ascending channel. The market now sits at a pivotal juncture, with upcoming sessions likely to determine whether ETH stabilises for another push higher or slips into a deeper retracement.

Technical Analysis

By Shayan

The Daily Chart

On the daily chart, Ethereum remains within its ascending channel, yet momentum has begun to weaken. The RSI has formed a bearish divergence against the price: while ETH posted higher highs, the RSI recorded lower highs, signalling fading bullish strength.

The price action is currently pressing against the channel’s mid-support around $4,200, a level that has repeatedly acted as a decisive demand zone. If the bulls hold this area, Ethereum retains the technical setup to challenge the $5K region in the medium term. A breakdown, however, would expose the $3.8K channel bottom, opening the way for a deeper correction.

The 4-Hour Chart

On the 4-hour timeframe, short-term weakness is more apparent. The ascending yellow trendline that guided ETH’s rally has been broken, confirming that buyers have lost grip on momentum. Since then, the asset has consolidated in a tight range, with the broken trendline capping moves to the upside and the channel’s midline providing support below.

This compression phase often precedes a decisive move. Unless ETH can reclaim $4.5K with conviction, the bias leans to the downside, with the $4.2K support remaining the key level to defend.

Sentiment Analysis

By Shayan

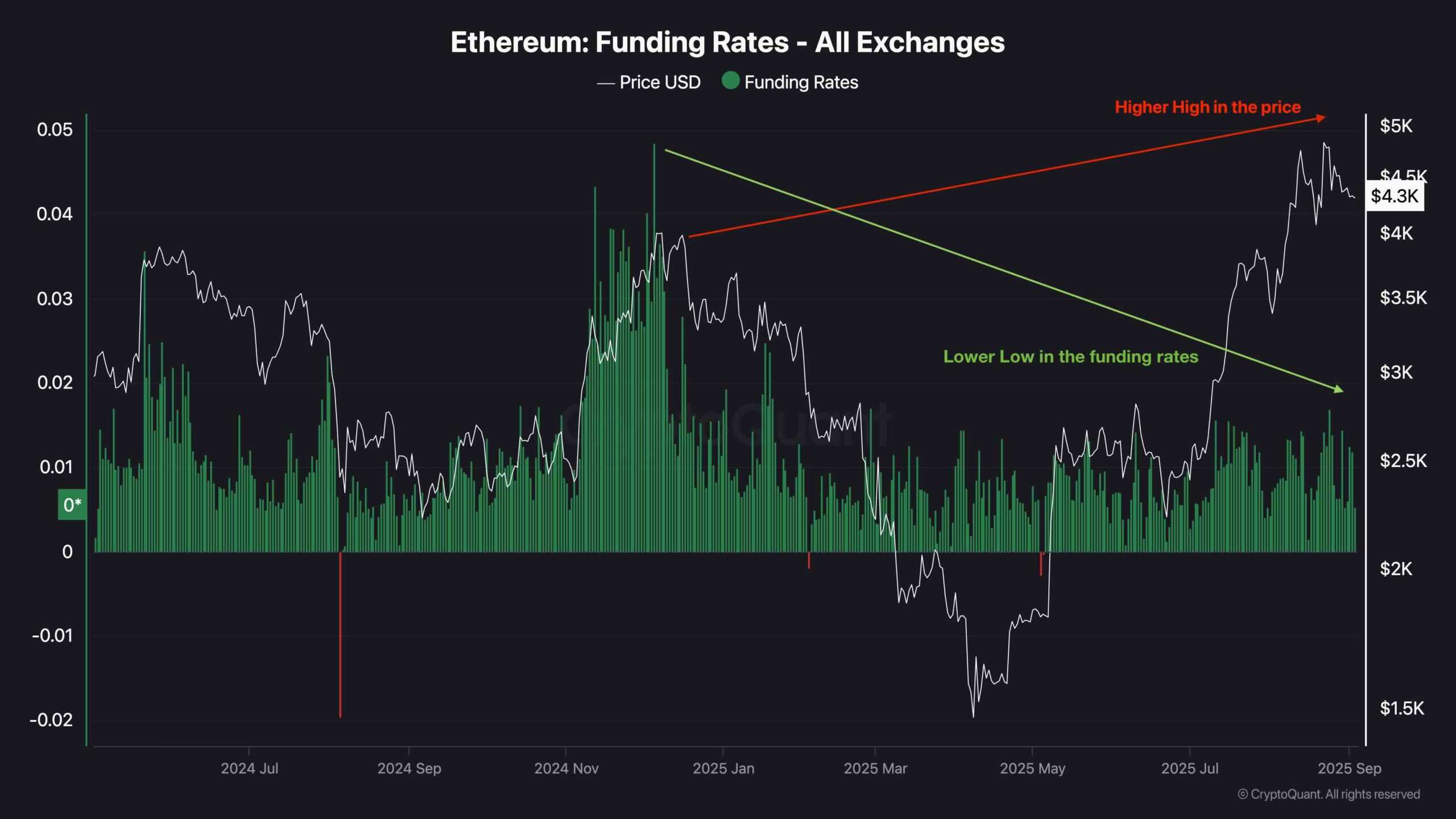

Funding rates across exchanges are showing a clear divergence from Ethereum’s price action. While ETH pushed to a higher high near $4.9K, funding rates peaked much lower than they did in the previous cycle, when Ether was trading closer to $4K.

This pattern, a lower high in funding rates against a higher high in price, indicates that traders are less willing to open aggressive leveraged long positions even as Ethereum sets new highs. Such behaviour suggests waning speculative enthusiasm in the derivatives market, despite spot price strength.

Historically, these divergences have often preceded exhaustion in bullish momentum, followed by periods of sideways consolidation or corrective pullbacks. Unless speculative demand revives, this signal reinforces caution in the short term, even as the broader bullish structure remains intact.

The post Ethereum Price Analysis: Pivotal Juncture Will Determine ETH’s Next Big Move appeared first on CryptoPotato.