TL;DR

- BNB drops 2% after all-time high; bearish pattern and $800 support zone now under watch.

- Futures Open Interest falls 1% to $1.48B; traders begin easing exposure after the price peak.

- B Strategy launches $1B treasury to back BNB projects, promises stricter governance controls.

Price Pulls Back From Recent High

BNB was trading at $840 at press time, down 2% over the past 24 hours. The move comes just three days after hitting a new all-time high of $900 on August 22. Over the past seven days, the price has stayed mostly flat.

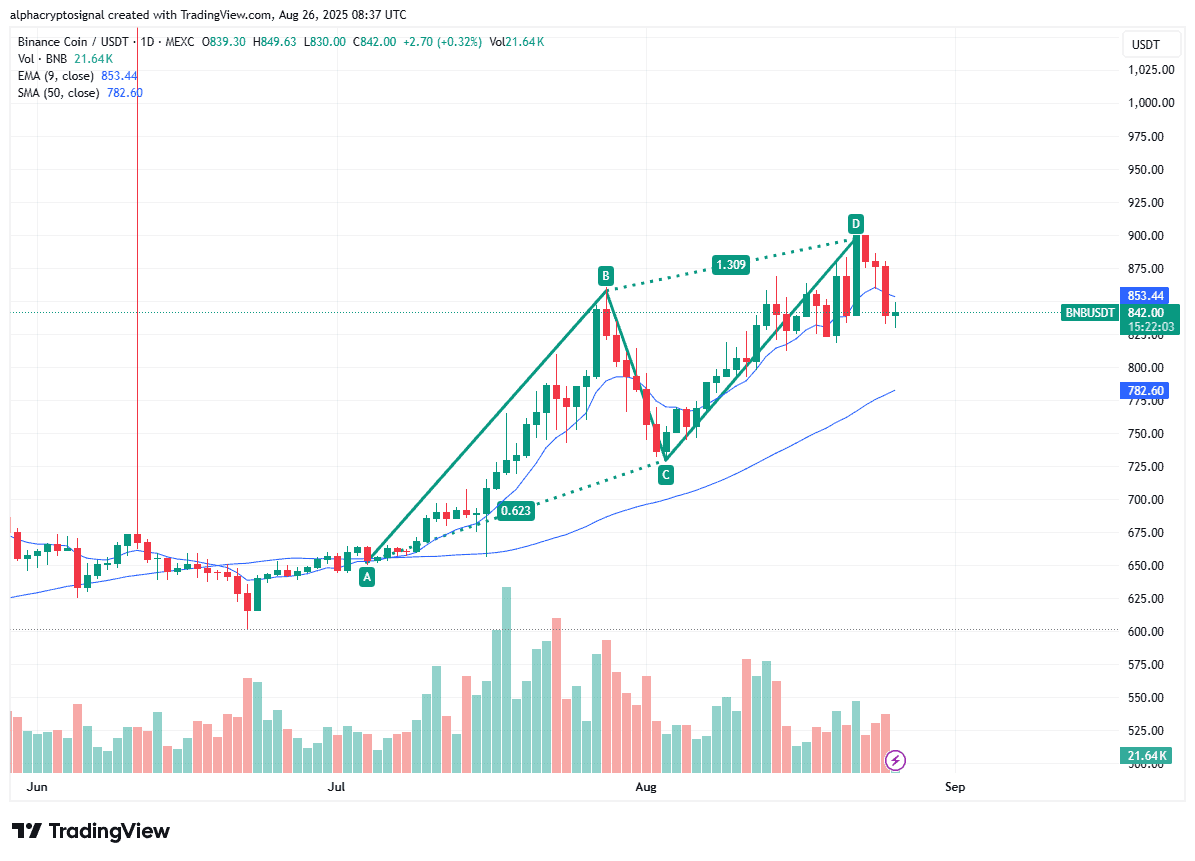

A bearish pattern may be forming on the daily chart, according to Alpha Crypto Signal. The ABCD setup looks complete, with the last leg topping out near $900. The price has since pulled back, but the broader uptrend remains intact. BNB remains above the 50-day moving average near $782.60 but has slipped under the 9-day average, now at $853.44.

Notably, traders are watching the $800 to $820 zone. This area has acted as support in recent weeks. If BNB holds above it, the current drop may pause. A move below could lead to further selling pressure.

Trading volume has slowed during this decline. This suggests that while buyers have stepped back, heavy selling hasn’t taken over. For now, the pattern is still developing. A stronger move below $800 would confirm a break in structure.

Futures Data Shows Traders Easing Exposure

Open Interest on BNB futures has dropped 1%, now sitting at $1.48 billion. Trading volume in futures has also pulled back by 9% to $1.88 billion. These numbers show traders reducing exposure after the recent price peak.

Even with the drop, Open Interest remains high compared to previous months. If the asset finds a base, new positions may build again. If not, more long positions could close.

New Treasury Fund and Market Oversight

B Strategy has shared plans to launch a $1 billion BNB treasury. The company is backed by YZi Labs and aims to support new projects and community growth on the BNB Chain.

At the same time, the BNB Network reportedly oversubscribed its $500 million fundraising round. However, caution remains after Windtree Therapeutics was delisted from Nasdaq due to BNB holdings. B Strategy responded by promising stronger governance, stating it would avoid similar outcomes.

The post BNB at Risk? Bearish Chart Pattern Signals Key Test Ahead appeared first on CryptoPotato.