[PRESS RELEASE – Bucharest, Romania, August 19th, 2025]

LYS Labs, the trailblazing machine-ready intelligence platform for Solana’s internet capital markets, has closed an oversubscribed $2M angel round and an additional $2M seed round, signaling a seismic shift in on-chain finance. LYS Labs is building the critical infrastructure that transforms unstructured blockchain data into actionable insights, enabling AI-driven agents to operate natively on-chain. Backed by crypto’s elite, such as Michael Heinrich (0G Labs), Piers Kicks (Delphi), Bruce Pon (Ocean Protocol), John Lilic (ex-Telos Foundation), Forest Bai (Foresight Ventures), and Scott Moore (Gitcoin), and institutional heavyweights like Alchemy Ventures, Frachtis, and Auros Global, LYS Labs is poised to redefine how machines engage with blockchain.

From Raw Data to Machine-Ready Finance

LYS Labs began building in November 2023, initially working across the EVM ecosystem, before shifting its full focus to Solana in November 2024, recognizing it as the most fertile ground and the biggest challenge for scaling internet capital markets.

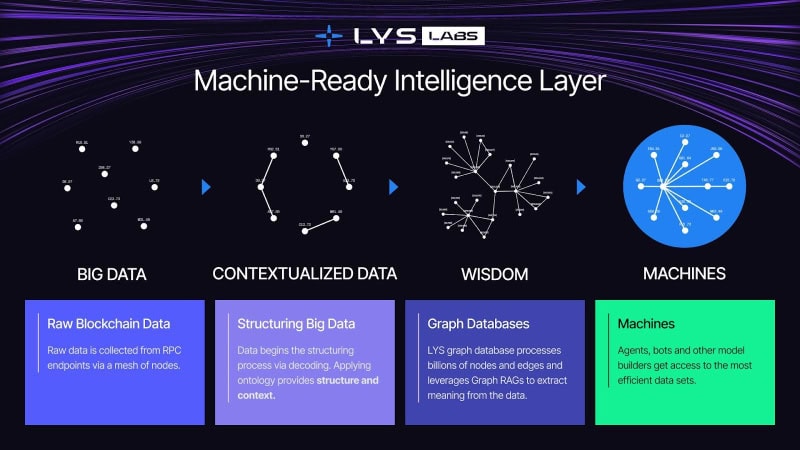

Today, the company has shipped its developer portal for raw data with sub-14ms latency and is already serving developers. Its structured, context-aware data stack is in testnet with a select group of users and benchmarking at around 30ms for its contextualized insights. LYS has also built several OG-RAGs (On-Chain Retrieval-Augmented Generators, which combine on-chain data with retrieval-augmented generation techniques) to power Solexys, an AI-driven, context-aware copilot that enables quants and sophisticated analysts to receive sophisticated signals, backtest strategies, and query blockchain data in natural language. Solexys is also live in the testnet with over 200 users.

The Structural Bottleneck in AI and Finance

The financial industry is increasingly shifting to on-chain, but unstructured blockchain data remains a barrier. Teams spend up to 70% of their resources cleaning and reconciling raw data before extracting insights, creating inefficiencies that limit true machine adoption. This process can take hours, days, or even weeks without the proper tooling.

In traditional markets, structured data is the foundation of Bloomberg terminals, quant models, and algorithmic execution. On-chain finance, by contrast, has been held back by messy, unstructured ledgers that lack semantic context. Structured, context-aware data changes the game: it transforms raw blockchain transactions into information streams that machines can understand, reason over, and act upon. Machine-ready intelligence refers to data that is structured, contextualized, and optimized for AI and machine learning algorithms to readily analyze and act upon. This enables AI-driven agents to move from simple retrieval to higher-order tasks like anomaly detection, second-order risk modeling, and autonomous execution. For institutions, this shift mirrors the leap from ticker tapes to Bloomberg, the difference between noise and intelligence, and ultimately between lagging behind and winning markets.

As machine-driven trading expands via bots, agents, and sophisticated AI models, structured, context-aware data becomes the critical bottleneck:

- The volume of on-chain data doubles roughly every 12 months, making human-driven analysis infeasible.

- Over $3 trillion in tokenized assets is projected to come on-chain by 2030, according to industry forecasts. LYS Labs aims to reduce data processing time by up to 50% and unlock 20% more efficiency in on-chain trading.

- Low-latency, high-context data streams are essential for machine finance, where even microsecond inefficiencies create competitive disadvantage.

“Markets are becoming machine-first before they are human-first,” said Marian Oancea, co-founder and technical lead of LYS Labs. “For AI agents to execute trades, detect anomalies, or build strategies autonomously, they need context-aware, structured data that can be processed instantly. That’s what we’re building—a data foundation where intelligence and execution can natively operate on-chain.”

Unlocking Solana’s Internet Capital Markets

LYS Labs’ mission aligns with Solana’s trajectory toward becoming the backbone of internet capital markets—a system where all financial instruments, from memecoins to RWAs, exist on-chain with transparent, machine-readable liquidity.

“Solana’s goal is to synchronize global information at the speed of light. We are here to support that,” said Andra Nicolau, co-founder of LYS Labs. “As intelligence and institutions come on-chain, the real unlock is not just raw data, but structured, machine-ready intelligence that allows new forms of capital allocation, faster markets, and entirely new financial products to emerge. Solana’s performance makes it the only chain capable of handling this at scale—and we’re building the intelligence layer that makes it usable.”

Roadmap: Multi-Chain Expansion and Agent Infrastructure

While Solana is LYS Labs’ immediate focus, the roadmap extends beyond a single ecosystem. LYS Labs is developing the infrastructure to capture cross-chain alpha in real time, enabling machines to seamlessly reason across multiple blockchains and surface opportunities invisible to human traders. Equally important, they are investing in the agent layer, where infrastructure is still immature. By building native support for agent execution – data pipelines, orchestration, and context layers – LYS Labs aims to close the gap between intelligence and action in machine finance. Their mission is clear: to make AI x crypto more efficient, more intelligent, and more seamless than ever before.

About LYS Labs

LYS Labs is building the machine-ready intelligence and execution layer for Solana’s internet capital markets. Founded in 2023, the company transforms unstructured blockchain data into institutional-grade intelligence, enabling AI agents, quants, and institutions to operate natively on-chain. LYS Labs is backed by leading angels from 0G Labs, Ocean Protocol, Flashbots, Gitcoin, Ripple, and more, along with institutional investors including Alchemy Ventures, Frachtis, and Auros Global.

Led by a seasoned team with a combined 30+ years in AI, 27+ years in crypto, and over 20 years in the risk mitigation and cybersecurity space, LYS Labs is well-positioned to lead this paradigm-shifting approach to capital deployment and management in the crypto space.

Users can visit https://lyslabs.ai to learn more.

Press Contact: business@lyslabs.ai

The post LYS Labs Raises $4M to Build Machine-Ready Intelligence Layer for Solana’s Internet Capital Markets appeared first on CryptoPotato.