TL;DR

- Over $2B in ETH longs could be liquidated if the price breaks below $4,200 support level.

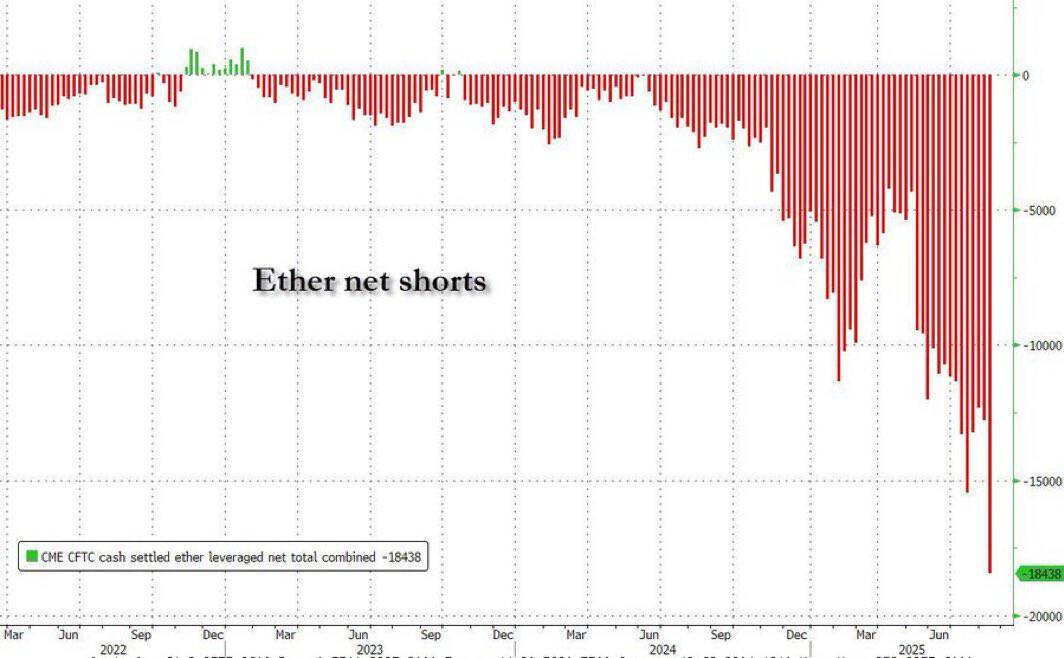

- Institutional short positions on ETH reach record highs while ETFs continue steady accumulation.

- Market awaits Powell’s speech, FOMC minutes, and jobless data to guide crypto’s next move.

$4,200 Becomes Key Support as Selling Risk Grows

Ethereum was trading at $4,280 at press time, following a 24-hour drop of 6% and a minor decline over the week. Analysts are closely watching the $4,200 level, where over $2 billion in long positions could be at risk of liquidation, according to Cipher X.

LIQUIDATION WARNING

• Over $2 Billion in longs could be liquidated if $ETH dips to $4,200

• That’s a massive liquidation cluster waiting to be triggered

• Breaking this level could spark a cascade of forced selling across exchanges. pic.twitter.com/DK6mmTajti

— Cipher X (@Cipher2X) August 18, 2025

Exchange data shows the largest concentration of leverage sits just below the current price. On Binance, liquidation exposure near this level stands at $52.18 million, with additional positions on OKX ($21.56M) and Bybit ($23.59M). “Breaking this level could spark a cascade of forced selling across exchanges,” Cipher X wrote.

Ethereum recently closed a weekly candle above $4,000, a level some analysts view as key for trend structure. Lennaert Snyder said any price action above $3,490 still supports an uptrend.

“Flipping $4,000 into support would be a very bullish retest,” he noted.

Support levels are currently marked around $4,240 to $4,190. Resistance sits higher, with the $4,550–$4,571 zone seen as a possible breakout area. Snyder identified $4,780 as a range high, and said a clean move above it could set the stage for a test of $5,000.

Short Positions Reach New Highs

At the same time, short interest on Ethereum has grown. According to Quinten, institutional short exposure through CME futures just hit an all-time high.

“ETH shorts hit record high,” they posted.

Spot accumulation by ETFs has continued, adding a layer of tension between spot demand and futures positioning.

If Ethereum holds current levels and turns upward, traders are watching for a possible short squeeze. That could force some positions to close rapidly, adding to price swings in both directions.

Key Events Ahead for Crypto and Broader Markets

Several events this week may shape market direction. These include the FOMC minutes on Wednesday, U.S. jobless claims on Thursday, and remarks from Fed Chair Jerome Powell on Friday. A separate meeting between Donald Trump and President Zelensky is also scheduled for today.

With ETH near a heavy liquidation zone and broader markets on edge, traders are preparing for high volatility around each event.

The post Ethereum Bulls Beware: $2B Liquidations Threaten the Rally at $4.2K appeared first on CryptoPotato.