In the fast-paced cryptocurrency landscape, very few platforms have managed to demonstrate adaptability, foresight, and user-centered innovation. LBank is one of them.

Founded all the way back in 2015, the exchange has grown into becoming a global powerhouse. It is recognized by many for its robust trading interface and for its ability to identify upcoming next-gen trends.

In this interview with Czhang Lin, Head of LBank Labs and Partner at LBank, we dive deepr into the platform’s story, its vision, while also exploring the advantages users can find in LBank Edge, as well as the growth of its derivatives platform.

Dive in to find more insights on early-stage blockchain investment, risk management, and what’s next for LBank as it positions itself at the heart of Web3 adoption.

LBank has grown into one of the most recognized global exchanges. What do you believe has been the key to its sustained growth and competitiveness in such a rapidly evolving cryptocurrency landscape?

As the saying goes, “Rome wasn’t built in a day.” LBank’s rise from an obscure name in 2015 to what is now widely recognized as the 100x gems hub has been a journey of consistency, innovation, and community-first thinking. LBank has adapted to market trends—such as the memecoin surge and DeFi’s expansion—while prioritizing value for users.

LBank’s listing strategy emphasizes high-potential, undervalued projects to deliver significant opportunities. The introduction of LBANK EDGE, a dedicated zone for high-growth assets backed by a $5 million fund and a 100% trading guarantee, highlights LBank’s commitment to combining innovation with user protection, ensuring sustained competitiveness in a dynamic market.

LBank Labs has been investing and incubating projects worldwide. What is your current thesis when it comes to supporting early-stage blockchain startups, and which regions or sectors are showing the most promise right now?

LBank Labs focuses on empowering innovative blockchain projects with scalable, high-impact potential, guided by thorough research. LBank Labs prioritizes investments in infrastructure, DeFi, and more, while remaining adaptable to emerging trends.

The intersection of AI, stablecoins, and real-world assets (RWAs) is particularly promising due to their scalability and alignment with regulatory frameworks, which supports broader adoption. Geographically, MENA, and Latin America are high-growth regions where decentralized solutions address tangible economic and social challenges.

LBank recently launched LBank Edge. Can you break down what it is and how it sets LBank apart from other exchanges offering similar trading features?

LBANK EDGE is more than just a new product feature—it’s a strategic initiative designed to empower early-stage, high-potential crypto projects while giving users a more secure and rewarding investment experience. At its core, LBank Edge is a curated asset discovery zone that combines intelligent listing mechanisms, strategic incubation, and advanced risk control.

One of the most distinctive features of LBANK EDGE is the 100% trading guarantee on select assets—under predefined conditions, eligible users may receive compensation for trading losses. This mechanism is designed to lower entry barriers for participants engaging with emerging tokens in high-volatility environments.

By combining selective access, downside protection, and $5M ecosystem fund support, LBANK EDGE represents a differentiated approach to asset incubation and secondary market participation—setting it apart from traditional listing models commonly seen across centralized exchanges.

Is LBank Edge more appropriate for seasoned traders or is it also a good place for novice users and newcomers to find “alpha”?

Neither limiting nor defining, LBANK EDGE is structured to be accessible to both novice and experienced traders, offering opportunities for significant returns. Tokens like USELESS (75x gains) and LAUNCHCOIN (152x gains) demonstrate LBANK EDGE’s capacity to deliver substantial value. By emphasizing accessibility and transparency, LBANK EDGE enables a broad range of users to explore high-growth opportunities in the crypto market.

Derivatives are becoming an increasingly dominant part of crypto trading. How is LBank Derivatives positioned in this market, and what innovations or unique offerings is it bringing to the table?

At its core, derivatives are a form of financial storytelling—they let traders express complex strategies and market views with precision. LBank Derivatives is built for professionals, but accessible enough for the everyday trader. It provides deep liquidity, rapid order matching, and support for a diverse range of assets, including altcoins and memecoins alongside major cryptocurrencies.

What’s exciting is that LBank is not just following the market—just shape it. Notably, LBank Derivatives’ ranking as a Top 4 exchange globally by derivatives volume on CoinGecko as of August 4th reflects its strong execution and market demand, positioning it as a key player in shaping the derivatives market.

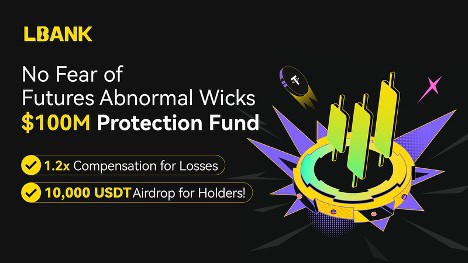

Risk management is critical in the derivatives space. What tools or mechanisms does LBank offer to ensure a secure trading environment for users engaged in leveraged products?

Security isn’t a side feature—it’s core infrastructure.

LBank’s $100 million Futures Risk Protection Fund, one of the largest in the industry, offers up to 120% compensation to users in the event of extreme market disruptions. This comprehensive approach to risk management underscores LBank’s commitment to user protection and sets a high standard for the industry.

Looking ahead to 2026 and beyond, where do you see LBank heading — especially in the context of evolving regulations, Web3 adoption, and the next wave of crypto users?

Regulation is a catalyst, not a constraint, for the future of crypto. LBank views regulation as an opportunity to expand into new markets and deliver customized, regional marketing strategies.

By 2026, LBank seeks to redefine the role of cryptocurrency exchanges, positioning itself as a premier platform for discovering and scaling high-quality crypto assets. Through initiatives like LBank Edge and its derivatives, LBank will focus on improving user experience, optimizing its products, and connecting with a diverse global audience to drive widespread adoption of the crypto economy.

The post From 100x Gems to High-Growth Strategies: How LBank Plans to Dominate the Next Crypto Wave – with Czhang Lin appeared first on CryptoPotato.