What to Know:

- Solana’s order books show renewed whale demand while spot $SOL ETFs log a multi-day inflow streak, reinforcing risk appetite.

- SoFi’s crypto rollout adds a mainstream on-ramp for US retail, a structural tailwind for altcoin participation.

- Bitcoin Hyper ($HYPER), Best Wallet Token ($BEST), and SPX6900 ($SPX) align with throughput, utility, and liquidity narratives that typically lead early in rotations.

Solana just lit up the order books. Fresh ‘smart money’ buy walls and block-sized prints show whales leaning in, with net spot inflows building across top venues.

The flow tells a simple story: big players are scaling bids into weakness and front-running a potential trend shift.

The backdrop helps. Spot Solana ETFs have now chalked up 10 straight days of net inflows, a rare streak during a choppy week for majors. That run, led by Bitwise’s $SOL fund, pushes the narrative toward persistent demand and strengthens the case for an alt rotation if risk stabilizes.

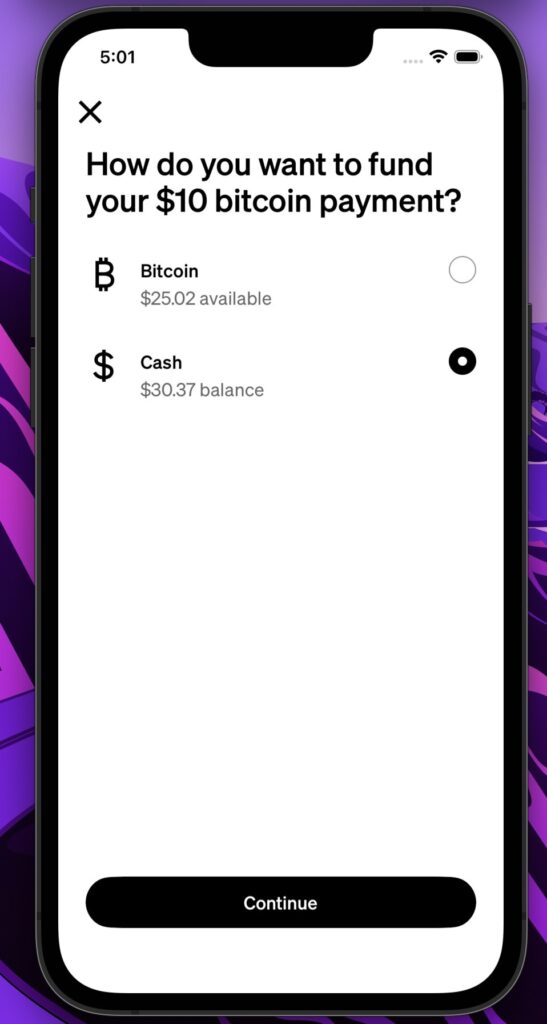

Retail rails are opening too. SoFi Bank has rolled out in-app crypto trading to its millions of customers, becoming the first nationally chartered US bank to offer crypto buying and selling – with Bitcoin, Ethereum, and Solana at the forefront.

Easier fiat on-ramps plus ETF flows and whale accumulation is the kind of three-piece puzzle that often precedes a broader alt rally.

With that macro tailwind in mind, three tokens stand out due to their fundamentals and timing – two presales riding clear narratives and one listed memecoin with heavyweight liquidity. It’s a focused watchlist for anyone scouting the best altcoins to watch into the year-end.

1. Bitcoin Hyper ($HYPER) – BTC L2 Built With SVM Speed

Bitcoin Hyper ($HYPER) takes a direct swing at the oldest pain point in crypto: slow and expensive $BTC transactions that negatively impact the ecosystem’s scalability.

The design funnels transactions to a Bitcoin-settled Layer 2 and uses the Solana Virtual Machine for high throughput execution. The result aims for near-instant finality, ZK-assisted validity, and periodic L1 commitments to keep security anchored to Bitcoin.

That’s serious design space for payments, dApps and even meme coins, with $BTC as the settlement bedrock.

If $SOL ETF inflows are a proxy for demand for high-speed chains, then a Bitcoin-secured L2 using SVM could capture overflow interest from developers and traders looking for $BTC-native performance.

Timing and numbers matter in presales.

The token is priced at $0.013265 with the presale sitting at $26.99M raised.

Based on the presale’s performance and Hyper’s utility proposition, a realistic price prediction for $HYPER puts it at $0.08625 by the end of 2026 and $0.253 by 2030. From today’s prices, these numbers translate into an ROI of 550% and 1,807% respectively.

Given that Hyper targets a Q4 2025 – Q1 2026 release window, the earlier you join the $HYPER train, the better. Make sure you read our guide on how to buy $HYPER first.

Visit the official presale page and buy your $HYPER today.

2. Best Wallet Token ($BEST) – Utility-First Wallet Ecosystem Token

$BEST is the native token for Best Wallet, a non-custodial, multi-chain wallet aiming to turn power-user features into default settings.

Think cross-chain swaps via an autorouter across 300+ DEXs and 30 bridges, MPC security without seed phrases, real-world spending with the upcoming crypto card, and a token launchpad baked into the app.

The token links to fee reductions, access, and ecosystem rewards across features that already map to daily crypto usage.

Presale mechanics are straightforward.

The token is live at $0.025935 with more than $17M raised. Our price prediction for $BEST outlines a potential 2026 high near $0.05106175, representing 96% gains.

For a wallet token, utility density is the tell – on-ramp integrations, multi-chain coverage, and soon, in-app staking partners build a clear reason to hold through volatility.

The tie-in to today’s flow: SoFi’s crypto rollout and $SOL ETF traction could nudge casual users to seek simple, secure self-custody with swap and bridge UX done right.

$BEST plugs that gap natively.

If you want in, make sure you read our guide on how to buy $BEST first.

Then visit the presale page and buy your $BEST today.

3. SPX6900 ($SPX) – Meme Liquidity With Big-Cap Exchange Reach

SPX6900 ($SPX) is a culture-driven meme asset with multi-chain reach and a simple message: internet-scale community meets exchange-grade liquidity. The token’s market cap sits above $615M, with $SPX sitting at $0.6609.

As attention rotates, high-beta meme names with deep order books often act as liquidity barometers. They move first, they move fast, and they draw flow.

Crucially, $SPX trades on Coinbase, which tends to boost retail access and tightens spreads for US users. That exchange reach matters when volatility returns and users want instant fills on familiar apps.

Recent Coinbase pages and converters reflect live SPX markets and volumes on the platform, while aggregators show additional venues and pairs. If ETF and banking rails keep onboarding newcomers, liquid memes like $SPX can catch outsized bursts.

And talking about bursts, $SPX showcases an all-time ROI of 25M%, which is literally a wealth-building performance.

So, go to your favorite exchange and buy your $SPX today.

Recap: Whales are scaling into $SOL, spot ETFs keep stacking inflows, and SoFi’s launch opens a bank-grade retail door. In that setup, Bitcoin Hyper ($HYPER), Best Wallet Token ($BEST), and SPX6900 ($SPX) each tap a live narrative – $BTC-secured speed, wallet-centric utility, and meme liquidity with top exchange access.

This isn’t financial advice. Do your own research before investing.

Authored by Aaron Walker, NewsBTC: https://www.newsbtc.com/news/best-altcoins-to-watch-as-solana-whales-start-accumulating/