Taxes can feel overwhelming, and this is even more so if you’re active in the crypto space. If your activity spans multiple exchanges, wallets, DeFi protocols, and NFTs, handling everything on your own can become not just challenging, but also costly.

CoinLedger aims to simplify that process. It offers fast imports, clean dashboards, and tax-ready reports that even a beginner can navigate with confidence.

In this review, I take a closer look at CoinLedger’s core features, its onboarding process and user experience, and how to import different platforms. I asses its performance capabilities, reliability, and customer support – all things that matter when deciding if CoinLedger is the right crypto tax software solution for your needs.

Key Takeaways:

- CoinLedger guides new users through onboarding very quickly and makes personalization simple.

- The tool can calculate cost basis and capital gains accurately and update reports instantly.

- The dashboard displays real-time portfolio insights and also highlights tax-loss harvesting opportunities.

- CoinLedger can import transactions through API, CSV, or wallet address syncing.

- It handles most DeFi and NFT activity well, but there are caveats.

The Verdict

CoinLedger stands out as one of the best crypto tax software solutions in 2025. It delivers a strong, user-friendly tool for managing crypto taxes, and this is especially true for users who operate across major exchanges, well-known Web3 wallets, and standard DeFi platforms. It features a smooth onboarding process, an intuitive interface, and a reliable transaction-import engine. Of course, it does have its own limitations. Those of you dealing with niche exchanges or experimental DeFi protocols may need to rely on manual edits and CSV uploads.

Overall, however, CoinLedger is a legitimate, secure, and reliable crypto tax software suitable for the majority of investors – from casual investors, frequent traders to professionals.

Rating:

4.8/5

10% OFF for Cryptopotato readers

- Very beginner-friendly interface

- Strong integrations with major exchanges & wallets

- Affordable pricing for smaller portfolios

- Fast, responsive and helpful customer support

- Secure platform with encrypted data & read-only APIs

- Manual fixes required for niche exchanges and tokens

- Limited advanced analytics features

- DeFi and NFT support still imperfect and may require manual tagging

Onboarding & User Experience

Quick summary: Registering a CoinLedger account is very easy. It’s obvious that the platform has done a good job in making sure that it’s beginner-friendly. The interface is clean and straightforward, while adjusting your individual settings is easy. CoinLedger offers a broad support for hundreds of centralized and decentralized exchanges, Web3 wallets, and platforms.

Creating an account

Creating an account with CoinLedger is extremely simple. The platform holds your hand and walks you through a few steps, which will help you better personalize your experience.

First things first, you can use your Google account, register with an email, or even use your Coinbase account. I reckon that the last option would be particularly helpful for US-based users.

As you start the process, CoinLedger will ask a few questions to fine-tune the platform to your needs.

First, you will be prompted to input your tax jurisdiction and currency. Don’t worry about the inputs, you can change that later as well.

Second, you will be asked about the primary purpose of you using CoinLedger. This is because it does a good job in both tax calculations and comprehensive portfolio tracking.

From there, you will be asked it if you want a DIY solution where you handle your taxes alone, or if you want to work with a CPA.

Once you select the answers of these questions, you will be entered into the main dashboard. But before we dive into it, there are a few more settings that you need to take care of.

Localization and Accounting Settings

Although you might have already selected the localization settings during the account setup process, I highly recommend that you double-check them.

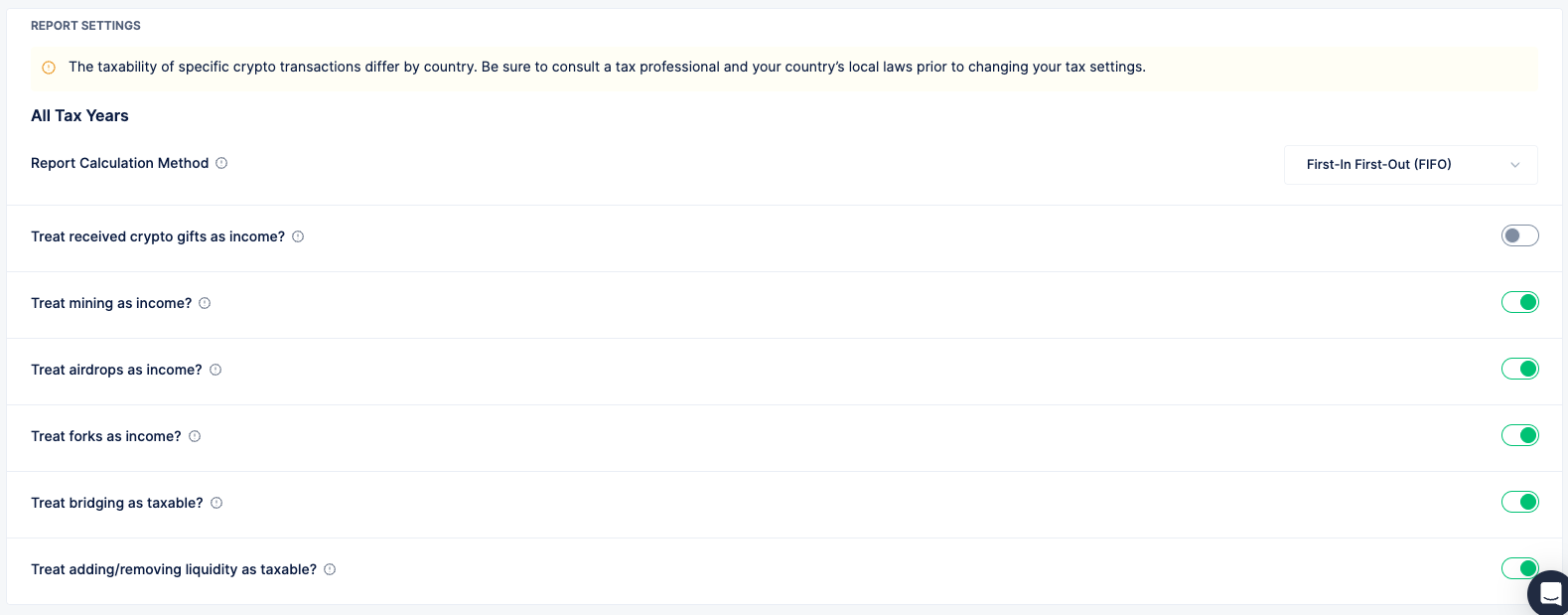

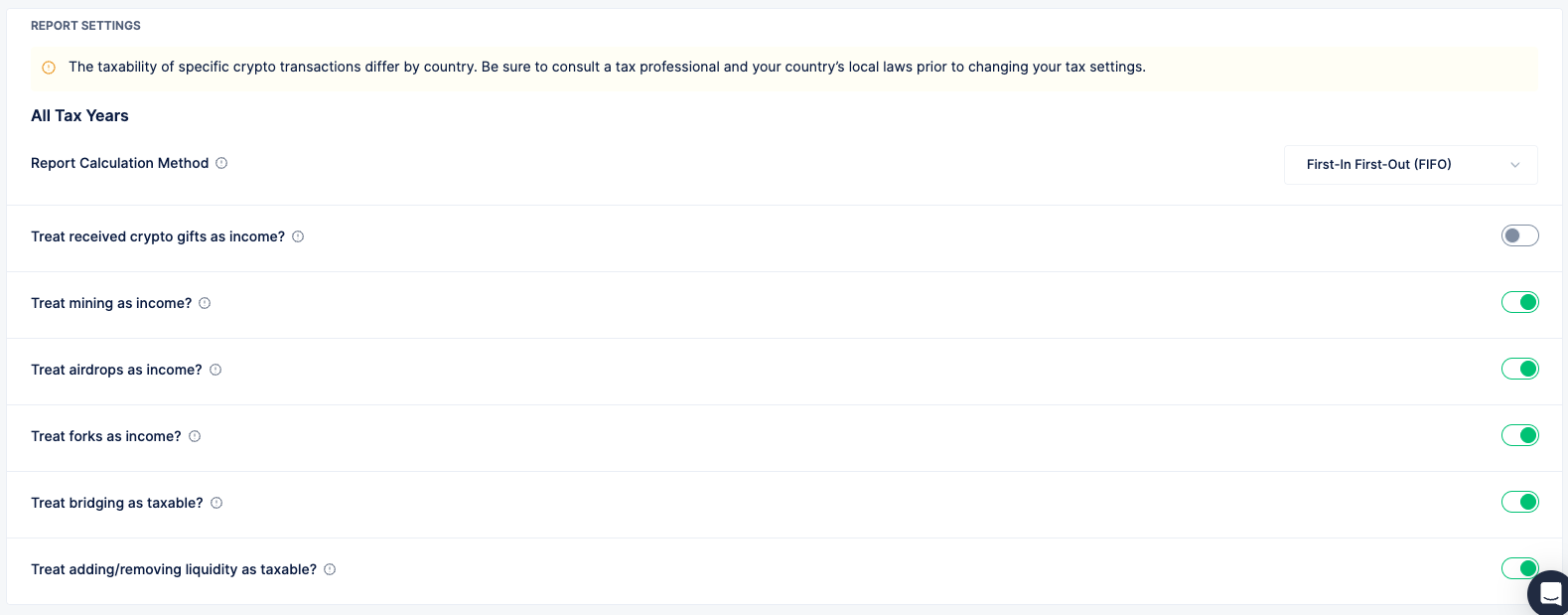

Click on your account icon (in the top right), go to Tax Settings, and from there, confirm your localization settings and take a look at the report settings.

You will notice that CoinLedger allows you to select the report calculation method. If you have read our guide on ways to optimize and/or decrease your crypto taxes, you should already be familiar with LIFO, FIFO, and HIFO. If you haven’t… well, what are you waiting for?

Also, please note that the ruleset is defaulted to your current jurisdiction, but if you find inconsistencies, you can easily change it.

Interface, dashboards, accessibility

From the get-go, it’s clear that CoinLedger is very suitable and oriented to users with little or no experience in working with crypto tax software.

The interface is clean and very easy to use. You have a Reports tab and a Portfolio tab that you can use, depending on whether you are currently focused on preparing your taxes or just want to monitor your performance and gain insights.

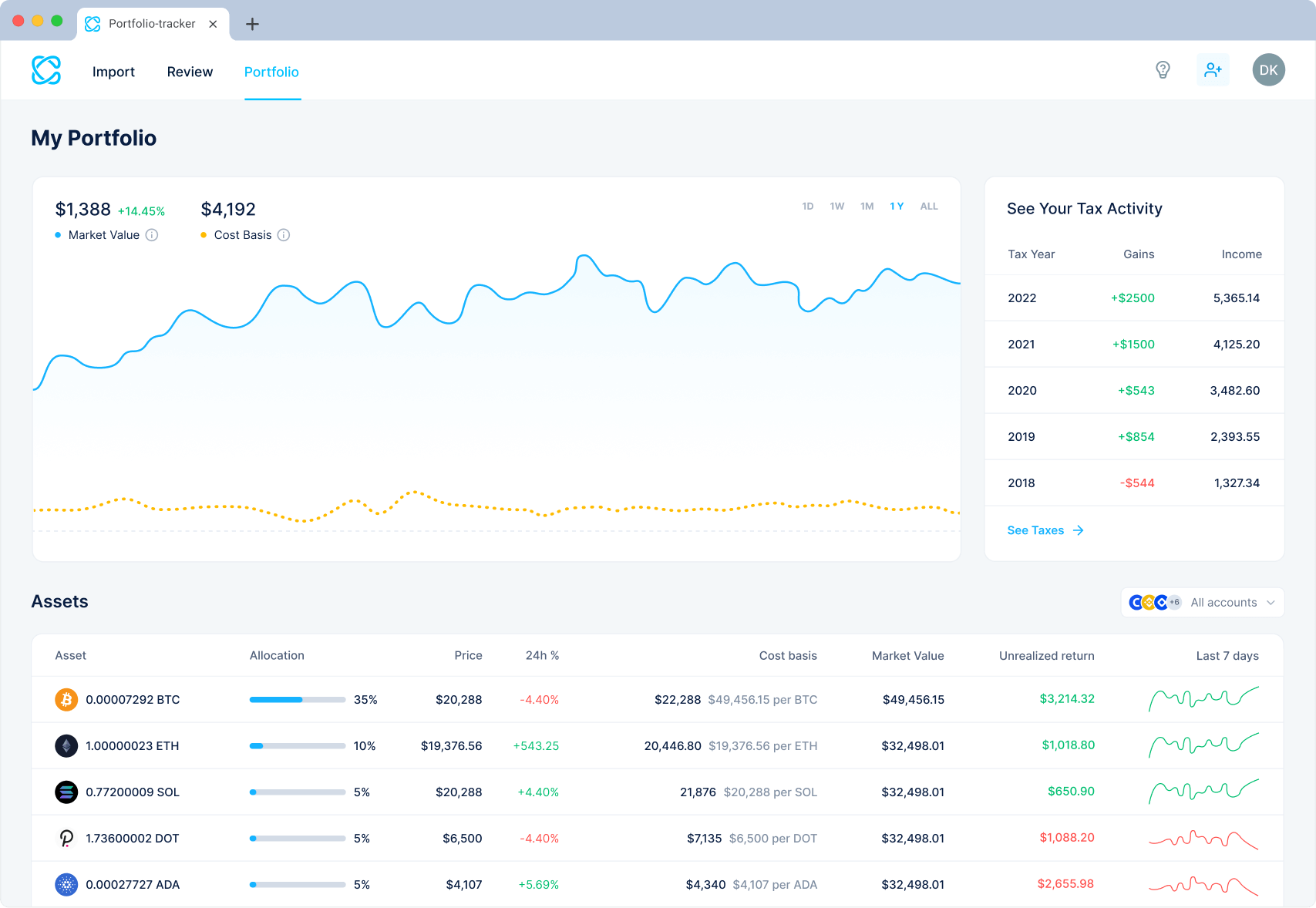

This is what the portfolio tracker looks like (image courtesy of CoinLedger):

As you can see, in addition to tracking your asset performance, CoinLedger also provides you with direct insights into your most recent tax activity.

Importing wallets, exchange APIs, and more

Now, when it comes to importing wallets and exchange data, CoinLedger makes it quite easy. Head to the top navigation menu and click on “Import.”

This is the screen you will see:

As you can see, there are hundreds of supported Web3 wallets, platforms, protocols, and exchanges. We’ve chosen MetaMask, which brings us to the next screen:

There are multiple options, with the auto-import being the recommended one, as all you would have to do is input your wallet address. CoinLedger will fetch all of its transaction history automatically.

All in all, the process is easy and quick. You will be able to handle it even if you have no prior experience in using platforms of this kind.

Supported Platforms

As you’ve already seen, CoinLedger supports all of the major exchanges. These include, but are not limited to:

- Coinbase

- Crypto.com

- Binance US

- Kraken

- KuCoin

- Coinbase Pro, and many more.

In terms of Web3 wallets, the software integrates with:

- Phantom

- MetaMask

- Trust Wallet

- Coinbase Wallet

- Exodus

- Ledger

- Trezor, and more.

I will talk about industry-specific integrations in the section below.

Core Features & Integrations

Quick summary: CoinLedger has a strong set of core features, all of which are built around quick transaction imports, accurate tax calculations, a unified portfolio-tracking system, and broad support for different transaction types. Its APIs syncing works very smoothly with the significant and well-known platforms. Features like tax-loss harvesting also allow for tax optimization.

Core Features

Transaction Import and Multi-Platform Integrations

In my experience, CoinLedger’s system of importing data is undoubtedly one of its core and strongest features. The API connections to the more mainstream exchanges, as well as Web3 wallets synced incredibly quickly. The platform managed to pull most of my trading history without any issues. There are also alternative import methods such as CSV and direct wallet address connections, making it convenient.

The interface makes it relatively easy to merge your data from multiple sources, which could be helpful to users who trade or invest on several exchanges and Web3 wallets. For the most part, the categorization was accurate. Having everything unified and displayed in one place also made the rest of the tax workflow very smooth.

That said, the only drawback I ran into was with smaller and lesser known exchanges, where I still had to rely on CSV uploads and some manual input. This is a very minot inconvenience and one that is present across the best crypto tax software I’ve tested.

Who it’s best for: Users who trade on mainstream exchanges and want smooth, reliable data syncing.

Pros:

- Fast API syncing with major exchanges.

- Clean, simple workflow for merging multi-platform activity.

- Accurate categorization for most transactions.

- Supports a wide range of exchanges, wallets, and chains.

Cons:

- CSV uploads needed for niche and lesser-known platforms.

- Occasional manual reclassification required.

Calculation of Cost-Basis, Capital Gains & Generating Reports

As you saw in the previous section, CoinLedger lets you select the cost-basis calculation method, which can come in very handy. The platform handles calculations and tracks gains and losses very well. It’s capable of processing thousands of transactions very quickly. It also presents its findings in an organized and easy-to-check format.

Generating tax documents, such as Form 8949 for US-based users, is straightforward. If you make any changes, the recalculations get updated instantly. It’s also very clear that the platform has been built with compliance in mind, as well as for standard buying, selling, and swapping activity, which it handles very reliably.

The only downside here, and again – I have seen this in other platforms (you can actually read about it in our Koinly review), is that for very complex DeFi transactions, you may still need to edit them manually.

Who it’s best for: Traders who want reliable tax calculation and simple generation of US tax forms.

Pros:

- Fast, accurate calculation of cost-basis and gain/loss.

- Generates standard US tax forms like Form 8949.

- Clear warnings for missing information or inconsistencies.

- Very easy to revise and recalculate reports.

Cons:

- Some complex DeFi transactions may need manual editing.

- It offers less robust tax-form support for non-US jurisdictions.

Portfolio Tracking & Tax-Loss Harvesting tools

In addition to everything it does tax-wise, CoinLedger also provides a consolidated portfolio view – something that I appreciate very much. It shows what you hold across all of the imported exchanges and Web3 wallets, while also tracking your gains and losses simultaneously.

Moreover, the tax-loss harvesting tool can come in quite handy. If you don’t know what tax-loss harvesting is, I once again urge you to read our guide on optimizing your crypto taxes. That said, the tool flags assets with unrealized losses and shows how selling them could offset your current taxable gains. This makes year-round tax planning a lot easier, not just during the filing season.

The only caveat here is that the accuracy of these insights is entirely dependent on having the complete transaction history – if anything is missing or if it’s not categorized properly, the numbers can be off. That’s why I’d make sure the imports are clean and on point.

Who it’s best for: Investors and traders who want unified portfolio visibility and proactive tax-planning solutions.

Pros:

- Clean and easy-to-navigate portfolio overview.

- Useful tax-loss harvesting suggestions.

- Good for year-round monitoring and planning.

- Fast, responsive calculations.

Cons:

- Missing transactions can distort portfolio insights.

- You must verify import accuracy for optimal results.

Handling of DeFi & NFT Transactions

CoinLedger supports a wide range of activities that I can categorize as non-standard. For example, it can reconcile micro-transactions, such as those that are typically generated by staking income. It also supports a range of different DeFi-oriented wallets.

The ability to import DeFi activities, as well as those associated with trading and/or investing in non-fungible tokens (NFTs) is absolutely mandatory in today’s crypto world.

It also classifies DeFi income as opposed to capital gains for more efficient and compliant crypto tax reporting.

I will have to repeat myself here, but it is what it is – very niche protocols or experimental DeFi features and complex transaction types sometimes came through as generic transfers. I had to label them manually.

Who it’s best for: Users who dabble in DeFi or NFTs and are looking for wide, albeit slightly imperfect and automated support.

Pros:

- Strong support for staking, swaps, and LP activity.

- Handles standard NFT trading very reliably.

- It has good tools for distinguishing income from gains.

Cons:

- Niche or edge DeFi protocols may not import properly.

- Some complex transactions may require manual tagging.

Audit Trail Reporting

It goes without saying that being able to identify issues and warnings is critical for a crypto tax software, and CoinLedger does a good job here.

You would receive all kinds of notifications, such as missing or incorrect transactions, duplicated entries, unmatched transfers, and so forth.

It will also flag if the cost-basis calculation method you are using is incorrect, and many more.

Who it’s best for: Users looking to audit existing entries.

Pros:

- Can flag incorrect cost-basis calculation methods.

- Sends timely notifications to identify various errors.

- Flags missing transactions or unmatched transfers.

Cons:

- Can occasionally miss flaggings and require manual verification.

Integrations

CoinLedger integrates with TurboTax, TaxAct, H&R Block, Taxslayer, and more. This makes exporting your reports particularly easy, as CoinLedger provides all the formats you might need without any additional adjustments.

It’s also possible to easily invite a tax professional directly into the platform. They can then access everything in a secure way and you wouldn’t have to email files back and forth. This cuts down friction and makes the review process a lot easier for both sides.

Of course, you will have to verify the imported forms if they look correct once they are inside the external tax software.

Pricing Plans

Quick Summary: all paid plans include exactly the same features; nothing is different. CoinLedger supports an unlimited number of transactions, but if you exceed the transaction count of the top plan (which is the “Pro”), you will be able to buy more directly into the app.

Free Plan

Cost: $0

Includes: Unlimited transaction imports and portfolio tracking, as well as a preview of gains and losses. If you want to generate reports, though, you will have to upgrade.

Best for: Entry-level investors or curious crypto users who want to test the platform and monitor their holdings before committing to a paid plan.

Hobbyist Plan

Cost: $49 per tax year (up to 100 transactions).

Includes: Full tax-report download capabilities, integration with various tax software, and support for major jurisdictions.

Best for: Casual crypto users with a small number of trades and standard wallets or exchanges.

Investor Plan

Cost: $99 per tax year (up to 1,000 transactions).

Includes: Same reporting features as previous plans but at a higher transaction volume, option for priority support.

Best for: More active users who execute hundreds of trades and require full tax documentation.

Pro Plan

Cost: $199 per tax year (up to 3,000 transactions).

Includes: Very high transaction count, advanced features like tax-loss harvesting, premium support, and audit trail.

Best for: Professional traders, users who work with multiple exchanges, wallets, and protocols.

Performance, Reliability & Support

Performance

CoinLedger has na impressive transaction-import engine, which pulls data from major exchanges, Web3 wallets, and blockchains. The process takes minutes, which I consider to be a strong plus, especially for active traders. Its infrastructure also uses robust encryption and read-only API access. Also, the platform is known for deploying fail-over systems for uninterrupted access during tax season. On the flipside, as I mentioned in this review, importing data from some obscure exchanges and lesser-known protocols may require you to manually import the CSV and then label transactions on your own.

Reliability

I’ve found CoinLedger to be very reliable, and that seems to be the consensus amongst the broad majority of users as well. User reviews on Trustpilot show a 4.6/5 score, and many of them praise consistent uptime, accurate calculations, and an overall dependable user experience.

Support

Customer support is another standout feature of CoinLedger. There are over 1,200 customer reviews on Trustpilot and the overwhelming majority of them report that CoinLedger support is knowledgeable and goes “above and beyond” to help people connect wallets, resolve import issues, or explain discrepancies in cost-basis calculations.

CoinLedger Pros and Cons

Pros:

- Very user-friendly interface: The simple layout makes importing transactions and generating tax reports very easy for beginners.

- Strong exchange and wallet integrations: CoinLedger supports many major platforms, offering quick and reliable automated importing.

- Affordable pricing for smaller portfolios: Lower-tier plans deliver full tax reports at a budget-friendly cost.

- Fast and helpful customer support: Users are praising quick responses and appropriate assistance when it comes to resolving issues.

- Secure platform architecture: Encrypted connections and read-only APIs provide very strong protection for user data.

Cons:

- Manual fixes required for niche assets: Less common exchanges (or tokens) may still require manual review or adjustments.

- Limited advanced analytics features: It’s pretty clear that CoinLedger focuses mainly on tax reporting rather than deeper portfolio performance insights.

- DeFi and NFT support is still evolving: Some complex DeFi transactions still require manual input.

CoinLedger Alternatives & Comparison

When choosing the best crypto tax software, you must undoubtedly also check out some of the alternative solutions available on the market. While CoinLedger excels in certain areas, it’s always important to at least consider what else is out there.

Notable alternatives to CoinLedger, which are also very highly-appreciated byt heir users include Koinly, CoinTracker, TokenTax, and CryptoTaxCalculator.

The following breakdown table should help you narrow down some specifics:

| Name |

Key Pros |

Price |

Rating |

|

|

- Seamless integration with major exchanges and tax filing software

- Advanced support for DeFi protocols, NFTs, and futures trading

- Strategic tax-loss harvesting capabilities to minimize liability

- Professional-grade reports ready for CPA review

|

Price:

$49 – $199 |

4.8/5

10% OFF for Cryptopotato readers

|

|

|

- Supports an extensive network of 700+ exchanges and blockchains

- Intuitive interface suitable for beginners and power users alike

- Multiple accounting methods with built-in tax optimization tools

- GDPR and SOC 2 certified for maximum data protection

|

Price:

$49 – $199 |

4.9/5

|

|

|

- Integrates with 500+ cryptocurrency exchanges and wallets

- One-click export functionality for TurboTax users

- Free portfolio monitoring with upgrade options available

- Clean, intuitive dashboard for effortless navigation

|

Price:

$59 – $599 |

4.7/5

20% OFF for Cryptopotato readers

|

|

|

- Comprehensive coverage of CEX and decentralized platforms

- Built-in CPA collaboration tools and audit defense support

- Real-time tax liability tracking during active trading sessions

- Automated profit and loss calculations across all positions

|

Price:

$65 – $1999 |

4.6/5

|

|

|

- Massive compatibility spanning thousands of protocols worldwide

- Smart AI-powered transaction categorization and error detection

- Specialized handling of complex DeFi and NFT transactions

- Responsive customer support known for quick resolutions

|

Price:

$49 – $499 |

4.5/5

|

Frequently Asked Questions (FAQs)

Is CoinLedger safe to use?

Yes, CoinLedger is safe to use. It offers a robust infrastructure and relies on read-only APIs, meaning that at no time of you using the platform, do you forfeit any sort of access to your accounts.

How much does CoinLedger cost?

CoinLedger offers a strong free plan, but it has limitations. The entry-level plan costs $49.

Is CoinLedger better than Koinly?

CoinLedger provides a somewhat friendlier user interface. However, Koinly does have superior support for more platforms and more powerful portfolio tracking features.

Which crypto tax software is free?

Most crypto tax software solutions have a free plan, but the majority of them come with serious limitations. You will most likely have to upgrade to a paid plan to generate reports.

Conclusion: is CoinLedger Legit?

Yes, CoinLedger is a legitimate and very credible crypto tax software. It offers secure data handling through read-only APIs and encrypted transfers, a transparent pricing model, and a robust set of features.

Of course, legitimacy doesn’t mean perfection. Much like most of the other crypto tax software solutions available online, CoinLedger faces certain challenges. Multiple lesser known exchanges, advanced and edge-case DeFi transaction types, or exotic tokens will likely require some manual work.

In short, for most individuals, active investors, and even professional traders, CoinLedger stands out as a very reliable and robust tool, that will help you file your crypto taxes with ease.

The post CoinLedger Review 2025: Pricing, Plans, and Features appeared first on CryptoPotato.