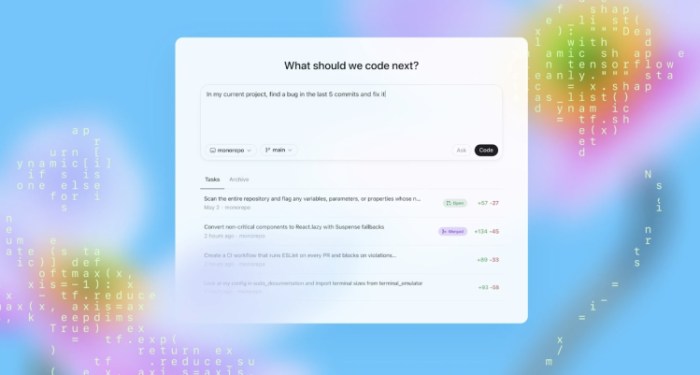

The coding community is buzzing with excitement as OpenAI announces the launch of Codex. It’s a cloud-based software engineering agent built to lend a helping hand.

Codex will allow developers to automate their work by tackling repetitive (but important) tasks on their behalf.

These include fixing bugs, drafting documentation, scaffolding new features, and renaming, refactoring, and writing tests.

Keep reading to learn more about Codex, including OpenAI’s intent behind it and why it’s a great example of where we’re headed with AI agents.

We’ll also touch upon the growing popularity of AI agents in crypto and DeFi and discuss why MIND of Pepe is the best AI agent in crypto today.

More About Codex

Starting now, ChatGPT Pro, Enterprise, and Team users can access Codex on their dashboard. Codex will usher in a new era in vibe coding, which, in case you didn’t know, is the practice of using AI tools for software engineering tasks.

Unlike traditional coding, which can result in opaque software difficult to debug, Codex has been built to explain exactly what it’s doing, which will help developers fix any future issues.

We’re about to undergo a pretty seismic shift in terms of how developers can be most accelerated by agents. – Alexander Embiricos, a member of OpenAI’s product team working on agents

Although you can already write code on ChatGPT, the Codex AI agent runs within a sandboxed environment in the cloud, allowing it to run commands and explore folders and even test the code autonomously.

OpenAI aims to develop Codex as a ‘virtual teammate’ instead of just an AI assistant. The company says that it’s already using the agent to automate repetitive tasks internally.

The launch of Codex is perhaps the perfect opportunity to talk about the AI agent market, which has been on fire in 2025.

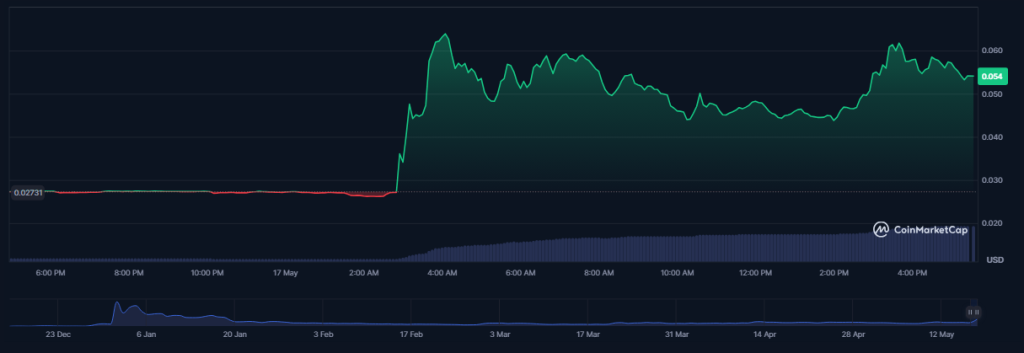

This DeFi segment surged past $5B in total valuation in 2024, and experts expect it to swell to a brain-melting $47B in the next five years. Just this week, AI-focused cryptocurrencies increased by $10B in market capitalization.

If you want to ride the growth of AI agents in crypto, MIND of Pepe could just be what you’re looking for. After all, it’s the perfect example to showcase just how powerful AI-crypto partnerships can get.

What Is MIND of Pepe ($MIND)?

$MIND is an autonomous AI agent armored with state-of-the-art hive-mind intelligence, which empowers it to assess social sentiments and market trends to identify the next cryptos to explode.

To put it more neatly:

- $MIND is an AI agent that lives on dApps and online platforms like X.

- There, it chats with the crypto community, acknowledging their insights and opinions on various altcoins.

- It then uses its AI capabilities to study these data points and find out which cryptos could rally as a result of brewing market hype.

It’s worth noting that this AI agent’s real-time crypto recommendations will only be available to $MIND token holders.

The $MIND Presale Is Ending Soon

Are you, too, guilty of scouring shady websites and scammy Discord/Telegram groups looking for the next big crypto coin? We know the feeling!

Well, both your disappointment as a crypto scout and the color red in your crypto portfolio are going to be a thing of the past in less than two weeks from now when MIND of Pepe finally goes live.

Speaking of the $MIND presale, it has had a fantastic run. Hundreds of thousands of investors have pooled over $9.4M in early funding, making MIND of Pepe one of the best crypto presales this year.

The presale is coming to an end, though. With less than 14 days to go, this is your last chance to buy $MIND for such a low price – just $0.0037515 per token.

If this is your first time buying a new meme coin on presale, here’s our detailed guide on how to buy MIND of Pepe.

The Benefits of Buying $MIND Are Endless

In addition to receiving its expert crypto investment advice, $MIND presale token holders will also get exclusive access to the tokens the AI agent creates firsthand.

You heard that right! MIND of Pepe, because it’s self-evolving, will ultimately have the smarts to create cryptos from scratch.

Naturally, these new cryptos will be based on what’s trending in the market, meaning they’ll be in a pole position to rocket to the moon.

What’s more, MIND of Pepe also has an extremely rewarding staking mechanism in place. At the time of writing, those who choose to stake their $MIND tokens will get 241% APY.

Unlock all these benefits by becoming an early investor in MIND of Pepe today.

Seeing as MIND of Pepe will bring about a massive shift in how the average crypto investor picks his portfolio, it should hardly be a surprise that our $MIND price prediction suggests that the token could reach $0.030 by the end of 2030.

So, if you become a $MIND investor now for just $0.0037515 per token, you could potentially make 800% in less than five years.

However, keep in mind that investments in crypto are highly risky on account of the market’s unpredictability and volatility. We urge you to do your own research. This article is not financial advice.