Fundstrat’s head of research Tom Lee says that Monday’s pullback in stocks is a buying opportunity despite growing economic issues in the US economy.

In a new interview on CNBC Television, Lee says that even though Moody’s downgraded the US’s credit rating from AAA to AA1 on Friday due to soaring national debt, he remains bullish on equities for the time being.

“I don’t know if there’s much signal in the downgrade Friday, because I think the first triple A downgrade was a signal from 2011. I don’t think Moody’s had any information that we didn’t have on Friday afternoon. So I think markets should realize the bond market is largely priced in the fact that the US is really not triple A anymore. So I’d be viewing this as a buying opportunity.”

Lee says that while the country has an unsustainable debt challenge, Treasury bond auctions are not failing, indicating that investor confidence remains in the United States.

“I think everyone should be aware that the US has an unsustainable path for debt. But I think the real signal will be when an auction fails. That happened a few years ago, and then we realized that was the time to really pay attention to the fact that we have debt sustainability issues. But I think a downgrade itself, I don’t think it’s much of a signal.”

Lee also says that many investors caught off guard by the stock market recovery since April’s severe correction will likely now reenter the market after being left on the sidelines, sending stocks higher.

“I’m assuming [Monday’s] pullback is going to be really shallow – might even close positive, because most investors rage-sold at the bottom in April, and so as the markets climbed, a lot of people sort of doubted it, thought it was a rally that would fail, and so I think there’s $7 trillion in cash on the sidelines, enormous skepticism from our institutional clients, and a lot of folks sort of bet outside the US. So I think it’s going be a lot of chasing into year-end…

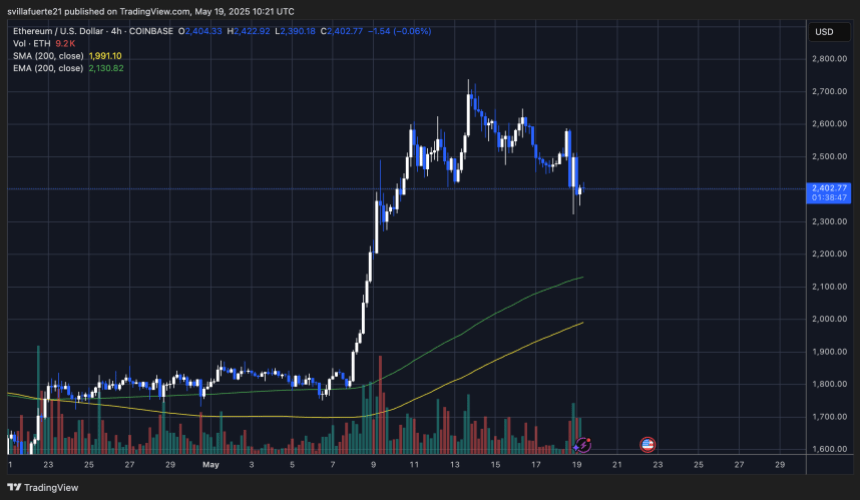

I think most people might be flat on their books, but if the market is above its 200-day, showing this sort of impulsive buying, and you’re flat, that means you’re underinvested.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

The post Fundstrat’s Tom Lee Says Stock Market Pullback a ‘Buying Opportunity’ Despite US Going Down Unsustainable Debt Path appeared first on The Daily Hodl.