The man who hacked an X account associated with the U.S. Securities and Exchange Commission (SEC) last year has been sentenced to 14 months behind bars for manipulating the value of Bitcoin (BTC).

In a new press release, the United States Attorney’s Office for the District of Columbia says that Eric Council Jr. – a 26-year-old man from Alabama – has been sentenced to over a year in prison for his role in the exploit, when he and others hacked the X account of the regulator a means of boosting BTC.

Authorities say that Council engaged in “SIM swaps,” or attacks on a mobile phone’s Subscriber Identity Module (SIM), which stores and authenticates unique user data and allows cellular devices to connect to mobile networks.

Prosecutors say that on January 9th, 2024, Council and others SIM-swapped the cell phone of a person associated with the SEC’s official X account to make a fake post and manipulate the price of BTC.

To pull off the scheme, Council created a fake ID card to trick AT&T store employees into giving him a replacement SIM card linked to the victim’s phone line. He then purchased a new iPhone, inserted the new SIM card and proceeded to reset the password of the SEC’s X account and shared the information with his co-conspirators before returning the phone for cash.

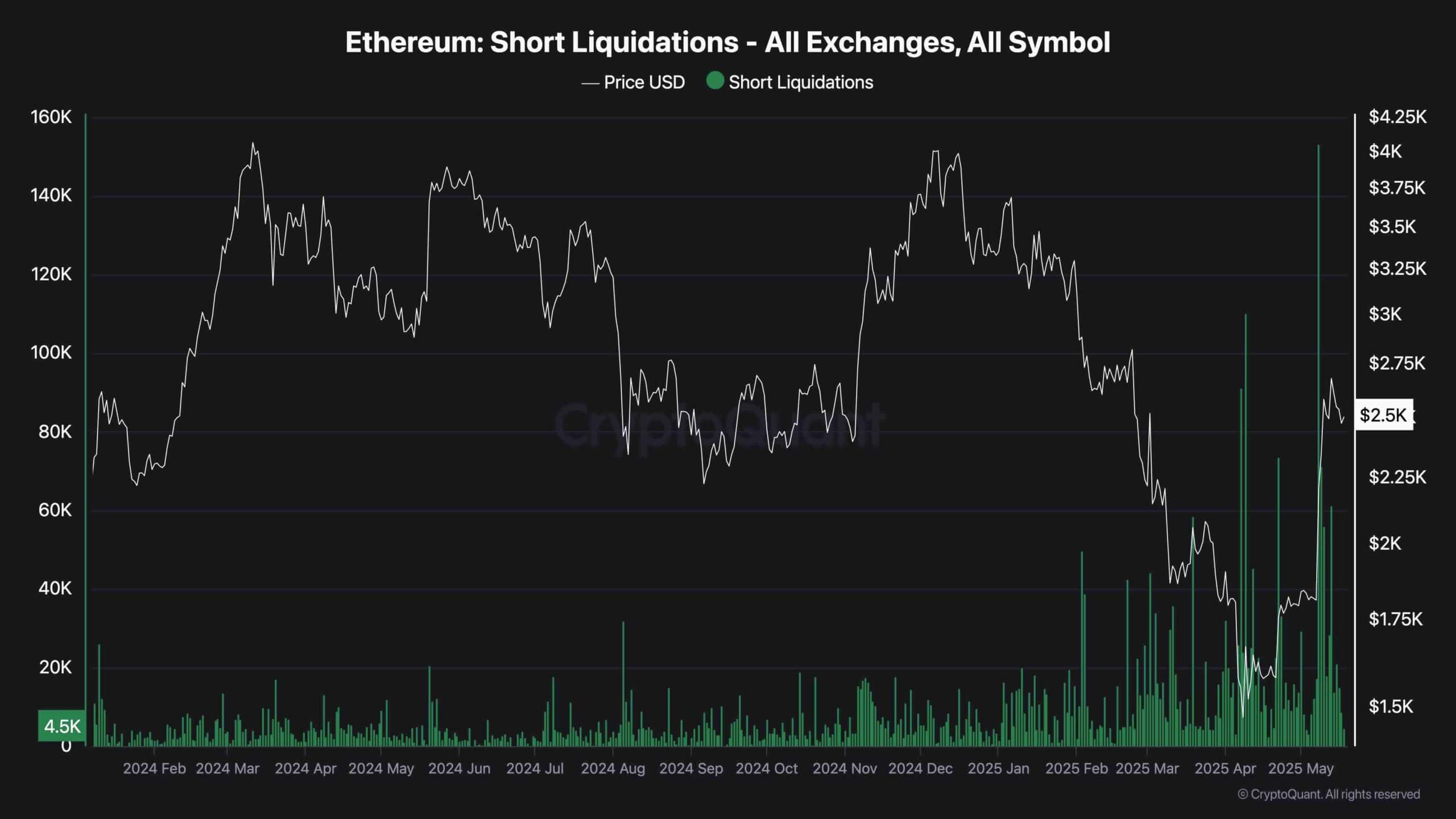

One of the crew members subsequently made a fake post using the official SEC account about how the regulatory agency had approved BTC-based exchange-traded funds (ETFs), which at the time were highly anticipated and pending approval.

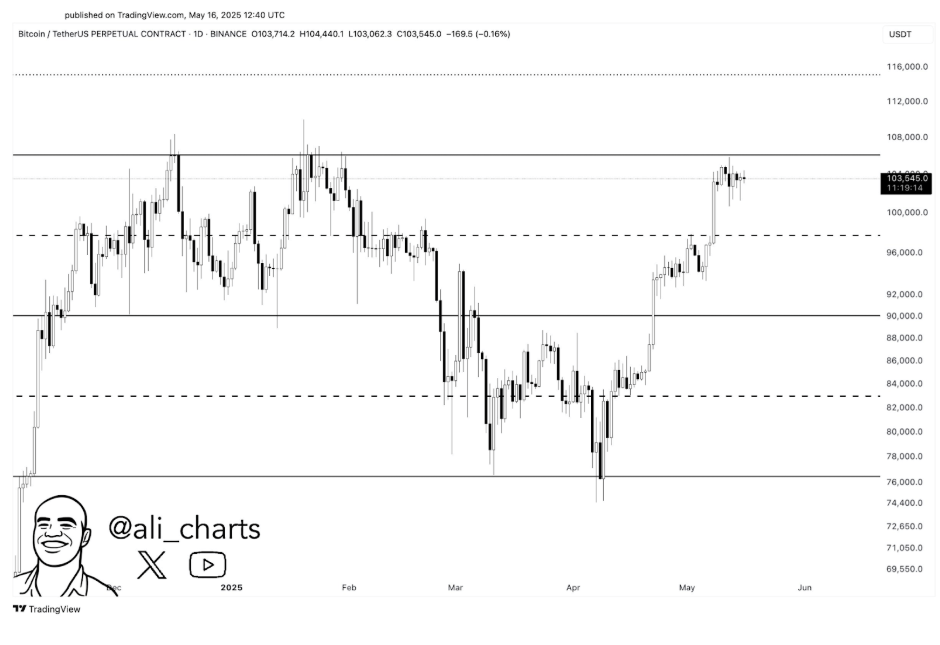

Following the post, BTC’s price rose by $1,000. However, after the SEC regained control of its account and confirmed that the post was fraudulent, BTC dipped by $2,000.

As stated by US Attorney Jeanine Pirro,

“Schemes of this nature threaten the health and integrity of our market system. SIM swap schemes threaten the financial security of average citizens, financial institutions, and government agencies.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Mastermind Behind SEC SIM Swapping Scheme Sentenced to 14 Months in Prison for Manipulating Bitcoin Price appeared first on The Daily Hodl.