The enhanced volatility in the cryptocurrency markets has returned in full force at the start of December, but in the right direction now.

After yesterday’s crash to under $84,000, the market leader went on a tear and surged past $91,000 minutes ago. The analysts from the Kobeissi Letter said the asset is on its way to paint its biggest daily increase since May this year.

They doubled down on their belief that these price swings are mechanical and have nothing to do with the industry’s fundamentals, which remain solid.

BREAKING: Bitcoin is on track for its biggest daily gain since May 2025, nearing $91,000, as levered short liquidations surge.

In the last 60 minutes alone, ~$140 million of shorts have been liquidated compared to just ~$3 million of longs.

Recent swings in crypto are ENTIRELY… https://t.co/cIDnDkvV6B pic.twitter.com/ElxAw4BUiw

— The Kobeissi Letter (@KobeissiLetter) December 2, 2025

Given the fact that the entire market plunged hard this time yesterday, the 24-hour charts are quite impressive now. Aside from BTC’s 7% surge, ETH has posted a 9% pump that has pushed it to $3,000. XRP has added over 7% of value, while SOL has skyrocketed by 12%. ADA is the top performer from the larger-cap alts, having surged by 15% to $0.43.

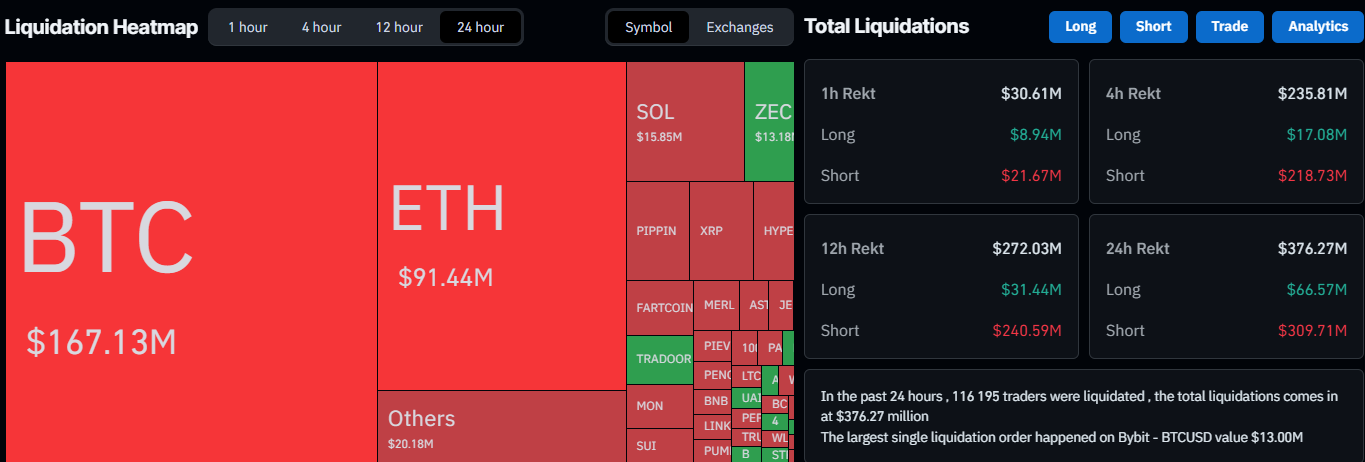

Naturally, these fluctuations have harmed over-leveraged traders. The total value of wrecked positions has risen to nearly $380 million, according to CoinGlass. This time, though, shorts are responsible for the lion’s share with more than $300 million.

Bitcoin shorts equal over half of the entire amount, followed by $91 million from ETH shorts. The single-largest liquidated position took place on Bybit and was worth $13 million.

Analysts remain bullish on BTC as long as it stays above key support zones, including $83,000, which was tested yesterday. Moreover, bitcoin’s rally could resume if the asset overcomes the next critical resistance at $91,800, which is just inches above.

The post Over $300M in Shorts Liquidated as Bitcoin Surges Past $91K appeared first on CryptoPotato.